The US dollar recovers. as the Fed and ECB plan rate hikes. After Boston Fed President Susan Collins made aggressive remarks, stressing the need to raise interest rates and the size of the increases will rely on data. The US dollar gained ground overnight.

US Dollar bounces back once more as the FED and ECB map out rate hikes,

Before Raphael Bostic from the Atlanta Fed dimmed the revelry by speculating that rates may peak in the upcoming summer.

Before Raphael Bostic from the Atlanta Fed dimmed the revelry by speculating that rates could peak in the upcoming summer. However, he did mention that raising rates gradually was the best course of action.

Christopher Waller, the governor of the Federal Reserve, also spoke after the bell and suggested that rate increases might be more forceful if the statistics called for it.

US dollar traders factoring 25 basis points

Nevertheless, a 25 basis point increase at the following three Federal Open Market Committee (FOMC) sessions is anticipated by the overnight index, switch (OIS), and futures markets.

The futures market implied a Fed final rate of almost 5.5 percent at one point overnight. Far removed from the 4.90 percentage-point prices that were set in Jan.

Treasury yields kept moving in the direction of fresh tops, with the benchmark two years note trading at 4.94%, the highest level since July 2007. And the 10-year note is firmly above 4 percent as it nudges 4.09 percent.

Treasury bond yields decline following a brief multi-day peak.

In the New York close, the US dollar index reversed the day’s losses, but it has since marginally slowed down in Asian trading.

Wall Street ended the day on a good note after a gloomy start, while the S&P 500 Futures indicated only modest losses by press time. Reflecting the atmosphere.

Additionally, the yield on US 10-year Treasury bonds increased to its highest level since early Nov 2022 and broke through the 4.0percentage barrier, while the two-year counterpart climbed to its highest point since 2007 at 4.94 percent The bond coupons have recently dropped from their multi-month peak, though.

The ECB is trying to catch up with US Fed

The European Central Bank appears to be playing catch-up as inflation statistics there reaccelerated, whereas the Fed is worried about being ahead of the curve when it comes to tightening.

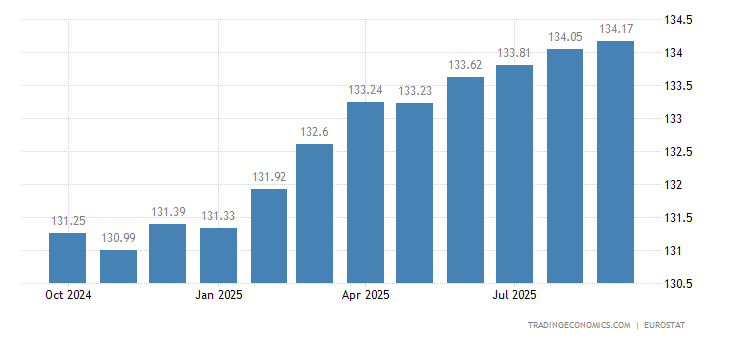

The CPI for February across the entire Eurozone jumped to 0.8 percent yesterday, significantly higher than the 0.5 percentage forecast and -0.2 percent previous. Compared to the prediction of 8.3 percent and the prior reading of 8.6%, the year-over-year read was 8.5%.

Source: TRADINGECONOMICS

Fed sentiment poll

It is important to note that the most recent Reuters survey predicts a weaker US dollar in a year amid an improving global economy and expectations. That the US Federal Reserve will stop raising interest rates well before the ECB

The dollar was predicted to trade weaker than present levels against all major currencies in the forthcoming 12 months. According to a survey of 69 currency experts taken from Feb 28 to March 2.

While Jerome Powell, the head of the Fed, will talk next week, San Francisco Fed President Mary Daly will address later today. He will present testimony on Tuesday when he delivers his semi-annual Monetary Policy Report before the Senate Finance Committee.

Key Technical Levels

| OVERVIEW | |

| Today last price | 104.97 |

| Today Daily Change | -0.01 |

| Today’s Daily Change % | -0.01% |

| Today daily open | 104.98 |

| TRENDS | |

| Daily SMA20 | 104 |

| Daily SMA50 | 103.37 |

| Daily SMA100 | 105.01 |

| Daily SMA200 | 106.82 |

| LEVELS | |

| Previous Daily High | 105.18 |

| Previous Daily Low | 104.34 |

| Previous Weekly High | 105.32 |

| Previous Weekly Low | 103.76 |

| Previous Monthly High | 105.36 |

| Previous Monthly Low | 100.81 |

| Daily Fibonacci 38.2% | 104.86 |

| Daily Fibonacci 61.8% | 104.66 |

| Daily Pivot Point S1 | 104.49 |

| Daily Pivot Point S2 | 103.99 |

| Daily Pivot Point S3 | 103.65 |

| Daily Pivot Point R1 | 105.33 |

| Daily Pivot Point R2 | 105.68 |

| Daily Pivot Point R3 | 106.17 |