S&P 500 and Nasdaq 100 weekly forecast – Hardline Fed talk and effects. Hardline Fed talk Is an effort to calm the bullish stock market trend

S&P 500 and Nasdaq 100 Weekly Sentiments Favors the Bull Trend – Key Points

Aggressive Fed language aims to maintain expectations among investors.

Fear index is at historic lows amid technical economic over-heating indicators

Upbeat Nasdaq 100: Price challenge the channel’s limits with no a significant retreat. The primary danger to the optimistic outlook looks to be Powell’s comments.

S&P 500 and NASDAQ FIGHTS FED AGGREESIVE TALK

Of Friday, notable Fed officials came out full force, repeating the lack-luster pace on inflationary core metric. And threatening future rate rises. Both Richmond Fed President Thomas Barkin and Fed Governor voiced worry about the absence of improvement in the broad pricing issues.

If new statistics don’t show convincingly that sluggish demand is bringing inflation back to 2 percent. The Fed’s Barkin signaled a desire for raising even further. Furthermore, Christopher Waller said he is concerned that the core inflation rate is stagnant which suggests “a few further tightness” would likely be needed.

The stock market disagrees over the Fed’s expectation for 2 further 25-bps rate rises prior hitting maximum rates. Which is supported by the recently revised synopsis of economic estimates. Investors presently account for a further rise, not a pair, but about 21 bps before speaking out. Jerome Powell frequently mentions his concern with PCE basic services minus home.

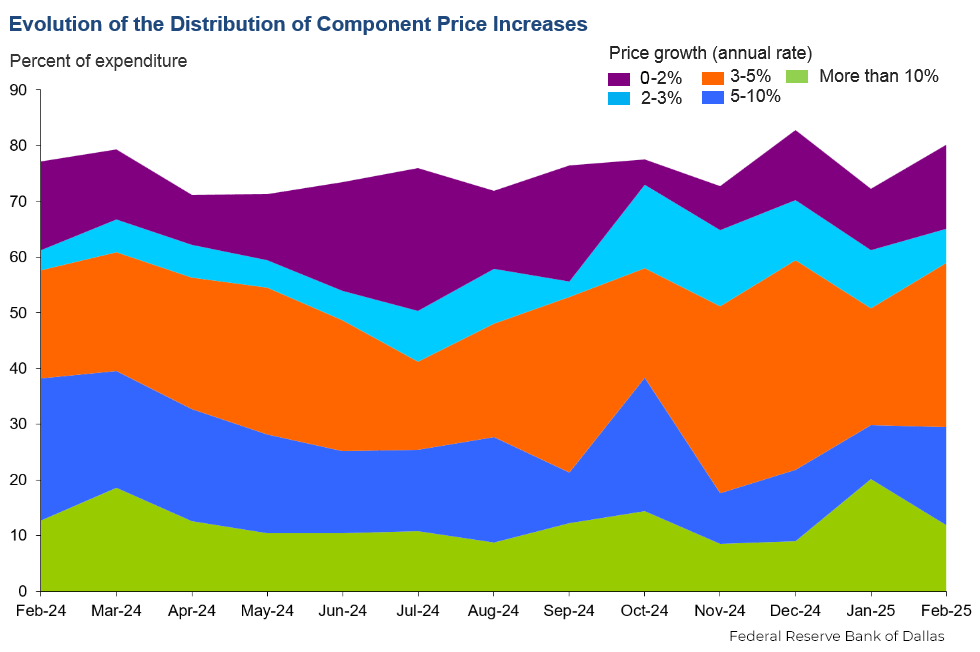

Cutoff Mean PCE Rate of Inflation

An alternate way to quantify core inflation within the cost index expenses (PCE) is the Reduced Mean PCE inflation rate. The Dallas Fed’s research calculates it using data gathered by the Bureau of Economic Analysis (BEA).

April 2023

Over the course of the past one year, concluding in April, the Trimmed Mean PCE rate of inflation was 4.8 percent. The BEA reports that the year rate of inflation for PCE overall was 4.4% and that it was 4.7% for PCE without regard to energy and food items.

The trimmed Median PCE inflation rate, overall PCE inflation, and PCE minus energy and food rate of inflation are all included

Six-month PCE inflation, annual rate

| Nov-22 | Dec-22 | Jan-23 | Feb-23 | Mar-23 | Apr-23 | |

| PCE | 4.3 | 2.7 | 4.1 | 4.2 | 3.7 | 3.5 |

| PCE ex F&E | 4.6 | 4.1 | 5.1 | 4.7 | 4.3 | 4.5 |

| Trimmed mean | 4.9 | 4.4 | 4.7 | 4.5 | 4.4 | 4.4 |

12-month PCE inflation

| Nov-22 | Dec-22 | Jan-23 | Feb-23 | Mar-23 | Apr-23 | |

| PCE | 5.7 | 5.3 | 5.4 | 5.1 | 4.2 | 4.4 |

| PCE ex F&E | 4.8 | 4.6 | 4.7 | 4.7 | 4.6 | 4.7 |

| Trimmed mean | 4.7 | 4.7 | 4.6 | 4.6 | 4.7 | 4.8 |

Source: Federal Reserve Bank of Dallas

BULLISH S&P 500 WEEKLY PREDICTION

It seems logical to suppose that profit take and prudence may influence the course of travelling coming up. Considering the strong upward trend which has occurred. The weekly graph is also approaching heating up, while the RSI indicator on the daily graph has long since crossed into overbought zone. The fear & greed indicators continue to be at extremely elevated levels of greed. Having have historically been associated with tipping times.

Then the reason the positive tilt if there are red-flashing caution signs? The (VIX) and absence of very significant US statistics provide the solution. It typically to go up amid tense situations or significant divestment of the S&P 500. This is sometimes caused by an increase in put options. That serve as safeguards against a declining equity market. Which we aren’t currently now noticing. In reality, the VIX is edging closer to its pre-covid highs and seems to be declining.

Technical Perspective

The S&P 500 is expected to increase by 3 percent during the week but seems to be handling the Fed’s cautionary statement well. The index continues to be dragged down by well-known companies in tech with artificial intelligence. While the resistance region near 4550 has grown clearly visible. The peak of the rising channel, the 78.6 percent Fib correction of the massive 2022 sell-off (4528). And the peak in Aug & Sept top of 4550. All fall inside this region of convergence. Support is located close to present levels and at 4327.50 mark

Weekly forecast for the NASDAQ 100: bullish Tilt

inevitably, the extremely tech-laden Nasdaq displays a comparable weekly plot. Though being markedly overvalued after recently breaching the highs of 15,260 in March and January. It is currently testing the 78.6 percent retrace of the significant 2022 fall. The next point of resistance, which related to the entire recovery of the massive sell-off in 2022, stands near 16,768. A positive mood must occur to push through this mark of barrier.

It’s additionally crucial to note that price activity marked the apex of the rising channel before easing a bit. Support is located near 14,367.50 area. Or about a thousand points below where it is now.