VOT Research Desk

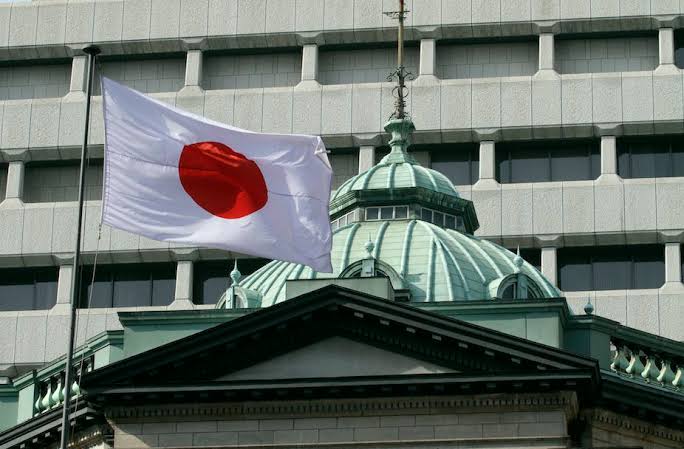

Asahi Noguchi, a board member of the Bank of Japan (BoJ), commented on the probable exit plan for the central bank and pointed out that it is still data-dependent. One requirement for the BoJ’s 2% inflation target to be met is a positive cycle of rising wages and inflation.

To achieve the BoJ’s 2% inflation target, wages must increase by around 3%. The Japanese public’s norm is beginning to alter as a result of the belief that costs won’t increase significantly.

The removal of stimulus won’t be possible with a single year of 3% wage growth alone. It’s difficult to predict right now how BoJ may modify tools if the easy policy were to end. Data would determine when the BoJ will roll back the stimulus.

Analyzing the statistics, I don’t believe that the necessary circumstances will arise to go. Anytime soon, simple policy. If underlying inflation accelerates faster than anticipated, the BoJ may withdraw stimulus measures in advance.

Although underlying trend inflation has not yet reached 2%, a change to the current easy policy cannot be ruled out if there is confidence that it will. In Japan, there is momentum for a simultaneous rise in inflation and wages.

When examining trend inflation, wage and service pricing are important considerations. If the BoJ were to abandon its easy policy, it would need to weigh its choices while taking into account the size of its balance sheet, the proper long-term rate objective, and the negative rate.

The hawkish remarks from the BoJ policymaker trigger a fresh bid wave for the Japanese Yen, which causes the USD/JPY to decline toward 136.00. The major is currently down 1.26% on the day and trading at 136.30.