EURUSD stays quoted at 1.0550 level, as it is focusing on risk patterns including Fedspeak. The pair appears to be stuck in a range.

EURUSD Key Points

The European currency is under pressure versus the USD.

Today, European stocks navigated a ocean of red.

The EURUSD lost a bit of steam and falls down below 1.0550.

The US dollar appears to be sold at the bottom 106.00 levels

The most recent inflation Eurozone statistics mirrored the earlier figures.

In the month of September, building starts increased 7.0 percent year on year.

On Wednesday afternoon, the Euro felt selling strain versus the US dollar, bringing EUR vs USD close to the 1.0550 level.

The US dollar remains around the bottom 106.00 zone as compared to the US dollar index. Amidst similar erratic price activity in international markets and a widespread wary approach. in response to rising global worries.

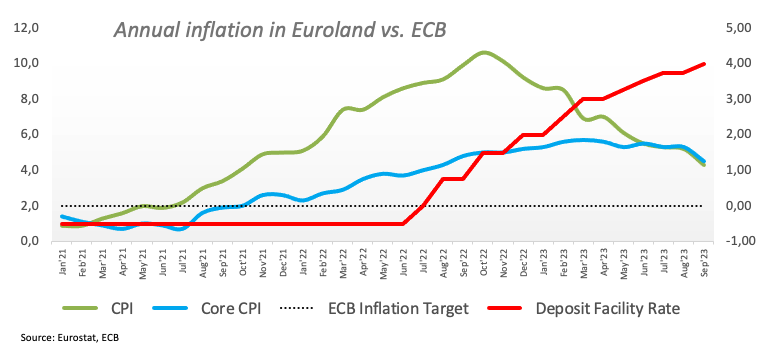

Investors are way of ECB future policy stance

Markets expect the Fed to maintain its stance of not increasing interest rates for the remainder of the fiscal year. As the focus remains on the economic outlook. In the meantime, financial sector investors are considering the likelihood of the ECB stopping policy changes. Notwithstanding rising inflation levels beyond the central bank’s objective and growing fears over the region’s economic slump or stagnation.

The latest Eurozone y – y inflation core data (Sept) exceeded early predictions of 4.5 percent. Decreasing from 5.3 percent in the month of Aug. Whereas the overall inflation rate decreased to 4.3 percent from 5.2 percent in August. Following the publication, the Euro scarcely changed, with investors rather focusing on broader economic problems.

Source Eurostat, ECB

EURUSD Technical Analysis & Perspective

Bullish Case

Should the upward movement continues, – the EURUSD could test its October 12 top of 1.0639. Plus, the 20th of September top of 1.0736 with the important 200- (D-SMA) of 1.0820. A surge over this point could point to an attempt to move over the 30th August high near 1.0945. while aim the psychological threshold of 1.1000 mark. Further rises beyond the 10th of August peak of 1.1064 could push the duo closer to the July 27 peak of 1.1149 & potentially even 18th of July peak of 1.1275 mark.

Bearish Case

If selling momentum remains, the 2023 bottom of 1.0448 dated October 3rd, along with the key support of 1.0400, may be probed. Should this mark is breached, the seven-day at 1.0290 could be retested.

The risk of continuing negative pressure looms throughout the period as the EURUSD remains beneath the 200-day SMA.