Crude oil establishes a price range after failing to rise.. Despite a weak US dollar on Friday, crude oil resisted a move higher.

Crude oil may rise in case US debit ceiling issue is resolved

The Price of Crude Oil Defines a Range The US debt ceiling is edging closer to the known X-date. The crude oil consolidates in the outset of the Monday after registering a little gain the previous week.

Monday is the scheduled day for the continuation of talks among US President Joe Biden and House Speaker Kevin McCarthy. On Sunday, they had a fruitful phone conversation, according to Mr. McCarthy.

Over the past several sessions, a weaker US dollar seems to be more noticeable in the pair of currencies and the price of gold. The ‘big buck’ received some support from rising Treasury rates. With the benchmark two-year note edging closer to 4.35% on Friday, after trading at 3.66% early in the month. Gaining Nothing

The Fed’s tone of comments is important

Jerome Powell, the head of the US Fed, made remarks on Friday that were maybe less aggressive than past comments. He said that, with reference to upcoming policy choices. that “the risks of implementing excess compared to doing inadequately are now more equal.”

Neel Kashkari, president of the Minneapolis Fed, also said he would be open to delaying a raise for the upcoming Federal Open Market Committee (FOMC) meeting in the middle of June.

Oil inventories in Focus

Canada’s provinces of Alberta, British Columbia, and Saskatchewan are dealing with major blazes,. And as consequence, less oil is likely to be produced nationally. According to present projections, there will be a daily decrease of roughly 250k barrels.

Following last week’s surprise increase in oil stock levels, the latest US (EIA) statistics will be issued on Wednesday and will be eagerly followed. Reserves increased by 5.04 million barrels, much above the 920k detraction that was projected.

Technical Perspective

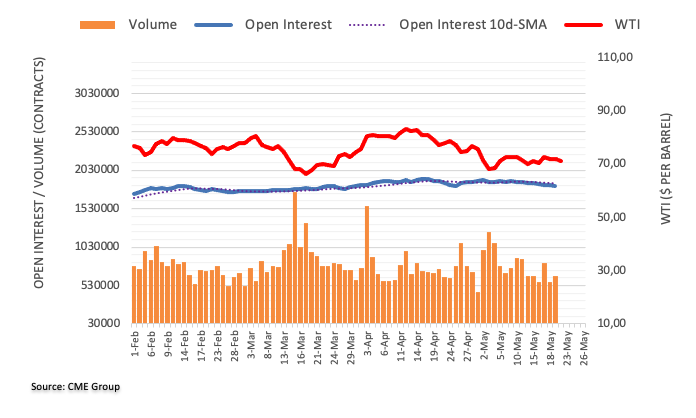

At the conclusion of the previous week, investors cut their open interest holdings by near 14.8K contracts. According to CME Group’s flash statistics for the oil futures markets. However, volumes at this point climbed over 83K contracts to maintain the choppy tendency.

WTI: $70.00 is the next level to fall.

Prices for WTI displayed some short-term stability on Friday with declining open interest and rising volume. However brief periods of contraction can’t be counted out too. Thus far, the $70.00 / barrel level should withstand the initial downward test.

Expected Oil Price Forecast

Tuesday, May 23, oil price prediction: 75.64 dollars, max 79.42 dollars, lowest 71.86 dollars. Brent oil price prediction for May 24th: 74.84 USD, highest 78.58 USD, least 71.10 USD. Thursday, May 25, price of oil prediction: 77.04 Dollar, peak 80.89 Dollar, minimal 73.19 Dollar. Estimate for Friday, May 26’s Brent oil price: 76.17 Dollars, with a peak of 79.98 and a low of 72.36.

Disclaimer

This projection relies on reports from market intelligence, information, and news sources. economic signaling. prevailing circumstances. Thorough technical & fundamental examination. and might alter at any time without warning. The use of this estimate may cause losses for which the firm is not liable.