Euro vs USD is surrounded by crucial technical stages, with a breach in sight. While the day comes to a close up, European stocks exhibit an uneven showing.

Euro vs US dollar pair key points

The euro is making a strong return and has approached 1.1000 against the U.S. dollar.

While the day comes to a close, European stocks exhibit an inconsistent result.

The EURUSD finds solid support at 1.0960 due to the Fed’s risk-off stance.

The USD Index is currently testing the 102.00 threshold.

From June, manufacturing output in Germany fell 1.5 percent month on month.

Investor trust in EMU grew in August.

Euro Recovered some of its weakness

On Monday, the Euro (EUR) regained little equilibrium and pares past declines vs the US the dollar. Aiding EURUSD to reclaim the 1.1000 region following dropping out at 1.0960 down.

The US dollar, on the contrary provides up a large portion of its initial profits as it now faces the 102.00 area. Once observed by the USD Index, coinciding about a drop of thrust in US yields throughout various time frames. As well as trader’s opinion of last Friday’s NFP details (+187K).

The EURUSD is starting the week from a negative after poor European economic reports and increasing US Treasury rates.

Nevertheless, volatility remains low, as numerous investors sitting in the fence prior to Thursday’s US inflation reveal. And this might be important to the US greenback.

US Economy in Spotlight for the EURUSD Pair

Concerning the second issue, it is crucial to highlight this, while the US economy created less employment than expected. Wage consistency with an better employment rate of 3.5 percent. Indicate that the job market’s sturdiness is mainly alive.

The FOMC’s Michelle Bowman‘s words confirmed the first pronounced leaning to the cautious area. She had previously during the session hinted at the prospect of additional rate rises.- (Maybe at the next session), should the effects of deflation abated.

The EURUSD fell roughly 0.15 percent to 1.0990 during early afternoon dealings. During a climate of low and reduced FX fluctuations, as traders largely avoid significant speculating bets prior to an important risk trigger(CPI). late this week

Headliner for July CPI is estimated to have increased 0.2 percent month on month. Raising the yearly increase to three percent versus 3.0% earlier. The core index, that removes food and energy, is expected to rise 0.2 percent month on month. While the annual figure is expected to fall to 4.7 percent versus 4.8 percent in June. Representing only a tiny gain for the US Federal Reserve.

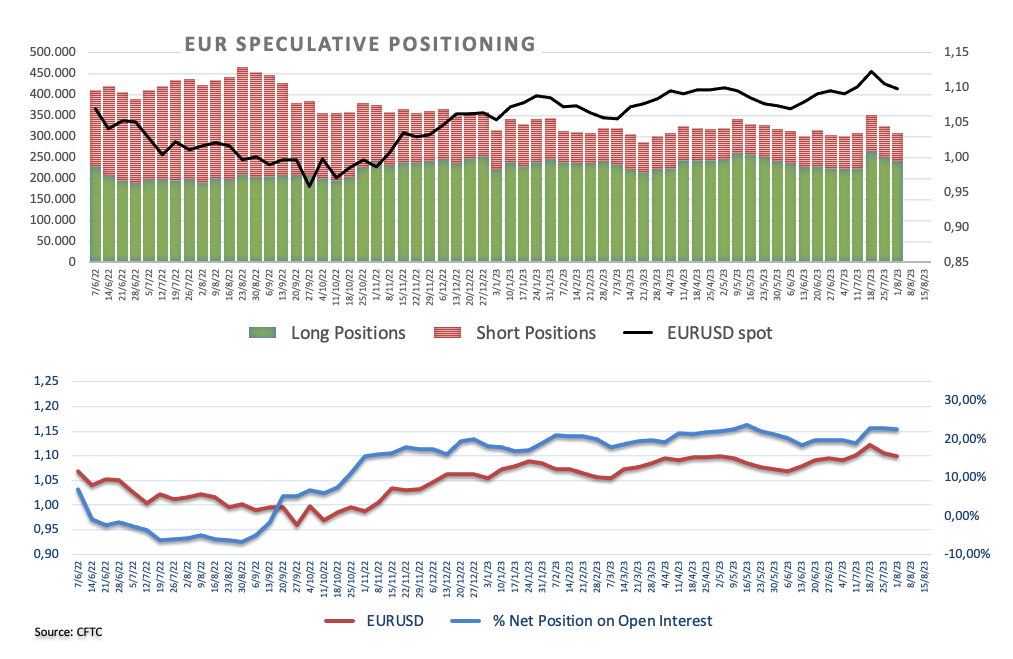

EURUSD Open Interest

This approach runs counter to popular belief that the Fed’s rate rise in July was the last one for the foreseeable future. Additionally, the possibility of the (ECB) imposing further restrictive steps after the summer appears to be slowly fading.

Based to the CFTC facts, EUR net longs fell slightly to a 3-week lower levels just around 172K contracts. During the week ending August 1. Over that time frame, spot rates seen its decrease increase following the FOMC & ECB monetary policy rulings on July 26 & 27.

Source: CFTC

In the Eurozone, the industrial output in Germany fell 1.5 percent monthly basis in June & 1.8 percent year on year. Furthermore, Market Sentiment as measured via the Sentix index dropped to -18.9 in August.

What Should You Be Watching Right Now?

It is critical to closely track incoming inflation data seeking knowledge of the wider market trend. With a focus on fundamental parameters. However, any core CPI figure over 4.7 percent would be fairly positive for the US dollar. As it may increase the chances of a further FOMC raise in the year 2023. Which might result in substantial declines for the EUR USD pair.

On the contrary hand, an important negative shock in the core inflation rate, maybe 4.6 percent or beneath. It may prompt the Fed to revise its monetary policy forecast. Putting a squeeze on Treasury rates. This situation might open the door for the euro to begin to rebound significantly versus the US dollar.

Technical Perspective and Projection

The EURUSD is under fresh selling stress and has breached the important psychological support level of 1.1000 mark

The fall of the 1.0920 area, in which the preliminary 55-day then 100-day SMAs meet. Exposes this pair to a likely decline that will hit the July bottom of 1.0833. Before hitting the crucial 200-day SMA near 1.0748 then the 31st May bottom at 1.0635 (May 31

The March bottom of 1.0516 (March 15) appears south on there, following the 2023 minimal of 1.0481 mark (from January 6).