VOT Research Desk

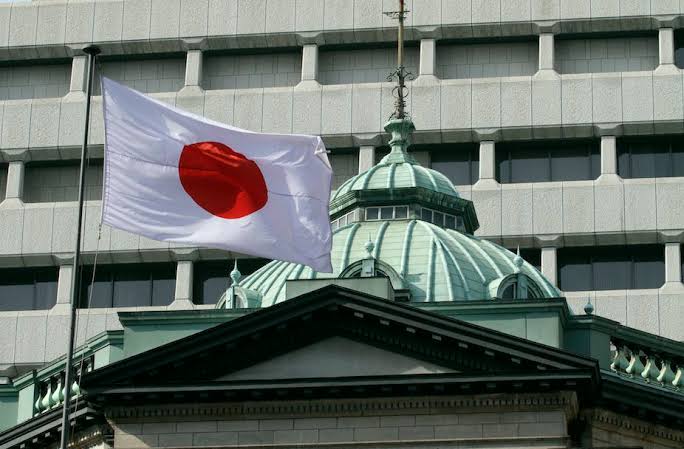

According to Takeo Hoshi, a scholar with connections to current central bank policymakers, the Bank of Japan (BoJ) may remove its 10-year Japanese government bond (JGB) yield cap in 2023 if inflation and wage growth are expected to be higher than expected.

To convince the public that it is serious about reflating the economy for a long enough period of time to produce sustained inflation, the BOJ must continue to pursue an ultra-loose monetary policy for the time being.

Since inflation expectations are already sufficiently high, core consumer inflation could rise above the BOJ’s target of 2% in the upcoming fiscal year, giving it room to forsake its 0% target for the yield on 10-year bonds.

In the past, prices in Japan did not grow significantly, but this is now changing. Japan could usher in a period of extreme inflation. The BOJ needs to start being concerned about the potential for inflation to accelerate more quickly than anticipated.