WTI further gloomy and bearish

Highlights Oil prices. Fall as demand in the United States and China falls WTI and Brent Crude fall below their 100-day MA

The EIA predicts that US oil output will rise while demand will fall.

Near-Term Crude Oil Trends: A Negative View Amidst Supply Fears

WTI Oil prices recently fell, erasing a previous spike that was fueled by fears about decreasing supply in the US and China. WTI & Brent crude oils remain under their 100- D-MA, showing that a negative trend is developing.

Consumption Trends in the United States & China

The EIA predicts a modest rise in oil output but a fall in consumption in the United States. Furthermore, per capita petrol usage is predicted to reach a 2-decade trough in 2023. In the Chinese mainland, dismal economic trends and reduced consumer costs have increased concerns about the country’s oil consumption. Prompting China’s refineries to ask for fewer barrels via Saudi Arabia for Dec.

Negative Market Forecast with Supporting Levels

Given such demand-side problems, the immediate forecast for crude oil is gloomy. Nevertheless, should WTI exceeds $75 / barrel, the market could gain backing because to projections of further production cutbacks

Supplier Specific Elements

On the supply side, the number of operating oil rigs in the United States has decreased, Showing a probable fall for subsequent production. It together with the impending OPEC+ conference, may have an impact on the price of oil.

In summary, though the short-term forecast for oil prices is gloomy. Due to supply motives and strategy actions by important oil-producing nations. supply-related problems and proactive choices by leading oil exporters might swing the market. The changing economic and geopolitical environments continue to be important in deciding the subsequent course of oil supplies.

Technical Analysis

Lighter oil futures have settled at $76.61 as week, somewhat lower than the closing price of $77.17. Implying a little decline. It is trading under its 200-day ($78.14) and 50-day ($85.70) MA’s signifying a more long-term negative tendency.

Source: TradinView

The close closeness to the small resistance zone at $77.43 may indicate that this mark will be tested soon. Should it miss to make it through. It could look for supports at $72.48 mark. Having a higher level of backing expected around $66.85.

In general, the market’s outlook seems pessimistic, with additional fall possible assuming present resistance marks stay.

WTI: A $70.00 testing shouldn’t be thrown out.

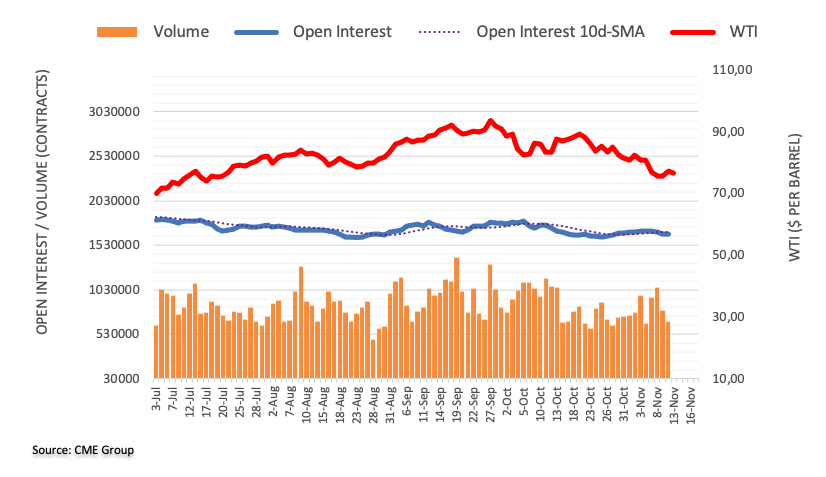

Although a significant comeback in WTI prices at the conclusion of the previous week. The positive effort was based on dropping trading interest and volume. keeping the door clear to a recurrence of the negative trend in the short term. In contrast, there’s no notable levels of support before the $70.00 / barrel threshold.