Crude WTI is struggling at a month’s bottom and is on course to record significant weekly declines. oil prices have fallen for a third consecutive day.

WTI crude oil Key Points

The WTI oil prices fell for the 3rd day in a row, hitting a month’s trough on Friday.

Concerns that increasing rates of interest may stifle economic development and reduce demand for petrol put pressure on the market.

Forecasts that the crude oil markets will stay tight in the immediate term provide little help.

WTI crude sailing in rough waters

(WTI) Crude oil prices fell for a third consecutive session today. Reaching the 6th day in a downward trend following the prior 7. Which touched a new a month’s trough. The oil price is now trading just over the $81.00 line, off more than 0.50 percent for the session. Which is at risk of extending its current strong retrace drop from the thirteen-month peak reached this past Thursday.

Traders are afraid about economic obstacles from rising rates of interest in the USA, that may reduce gasoline consumption. That has played a major role in the current savage selling in oil values. That have dropped about 13 dollars. Which is more than 13.5 percent, from the $94.00 a barrel level reached this past week. At the same time, the adverse element, to a greater degree, dominates concerns about limiting worldwide petroleum supplies and promotes the possibility of further depreciation.

Oil prices are on track for their worst weekly drop early March of this year. And WTI selling at $82.28/barrel with Brent falling under $84/barrel,

This EIA’s estimate of a huge petrol stockpile increase and poor petrol demand. Together with the bond market’s selling. Which is causing a change on the oil market’s attitude at the moment.

The move by OPEC+ to extend its output reduction program has minimal influence overall oil prices. Since investors have grown considerably more concerned about economic issues.

Traders are on the sidelines before NFP data in US Session

Investors, on the other hand, are hesitant to put bold wagers and may opt to remain on their heels. Prior to the publication of critical US monthly job (NFP) data. Which is coming late in the initial US period. The widely publicized NFP data will affect the Fed’s future policy action. That will fuel the need. That, in consequently, should offer some considerable push to oil priced in US dollars, such as the price of crude oil.

Current Crude oil Trading Pricing

| Futures & Indexes | Last | Change | % Change | Last Updated | |

| WTI Crude | 82.25 | -0.06 | -0.07% | (12 Minutes Delay) | |

| Brent Crude | 83.97 | -0.10 | +0.25 |

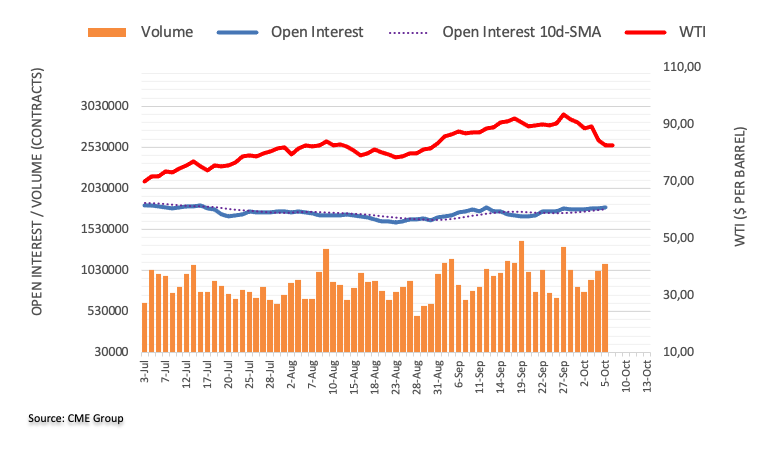

Trader’s open Interest Positioning

According to CME Group’s flash statistics for the WTI oil futures trading, investors added near 10,600 deals on Thursday afternoon. Correcting the preceding day’s decrease. Volumes grew for the 3rd period in a straight, currently by roughly 81.2K contract deals.