Crude oil prices in the United States are approaching $100 zone amid markets anticipate decreased delivery.

Crude WTI surges to the $95.00 area- Before Correction

WTI Crude prices have risen for a third day in a row, reaching a yearly peak.

The EIA reveal, which was issued on Wed, referred to signals of lower availability and provided assistance.

China’s expectations for growth stay positive of the continued good trend.

On Thursday, oil’s reference prices reached the highest mark for over thirteen-months. While investors fretted over the impact of additional output cutbacks on the world’s economy. Which is still reeling from its recent hyperinflation jolt.

WTI crude in the United States briefly surpassed $95 for the inaugural price before the end of August. When the global market for Brent oil touched $97 in the UK. The specter of $100 crude is clearly stalking this market once more. While its relevance is primarily psychological, it will be uncomfortable for organizations, governments, as well as consumers. Whom were originally expecting for some solace from increased consumer costs.

In keeping with statistics released on Wed by the US (EIA). The US crude oil stocks fell by 2.169 mil barrels in excess of predicted for the seven days ending on September 22. It’s the 2nd week in a row of declines, and it follows on the heels of significant production That, in consequently, increases chances that supply worldwide will shrink more during the year, acting as a boost for crude oil pricing.

On October 4, the Organization (OPEC) will convene anew to go over anticipated output cutbacks. Existing group cutbacks, in addition to additional, unilateral cuts from major suppliers Saudi Arabia & Russia, are expected to remove 1.3 million bpd off marketplaces till perhaps the conclusion of the year.

Meanwhile, an update suggesting that inventories at a major US storing hubs were at their least as of prior July provided a graphic representation of supplies constraint to buyers. The Cushing, Oklahoma is the shipping venue for oil futures deals. While inventories therein are having significantly decreased by higher processing and better shipments.

Crude oil Key Points (Thursday)

On Thursday, US oil prices reached the highest stage until August 2022, after industrial stockpiles maintained their fall.

WTI crude briefly topped $95 / barrel prior to resuming their decline under $94 area.

The EIA announced a stock drawdown which was much greater than predicted on Yesterday.

Current WT Trading Price

| Futures & Indexes | Last | Change | % Change | Last Updated |

| WTI Crude | 93.10 | -0.58 | -0.62% |

Open Interest

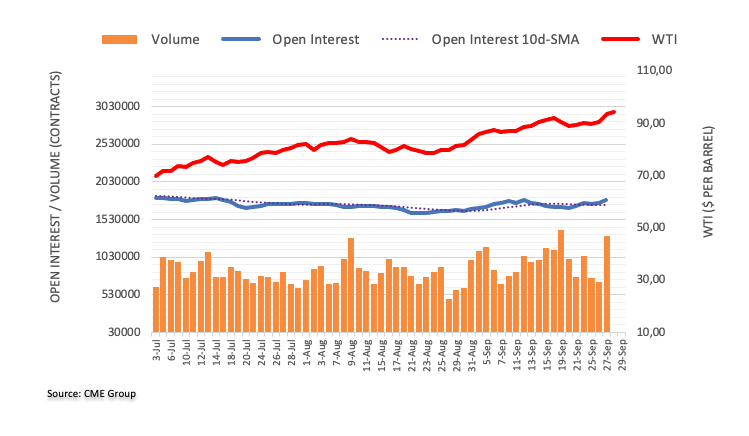

Using CME Group updated scans for the oil futures trading, open interest jumped by in excess of 35,000 lots on Wed. Building further to the prior day’s gain. Volume joined the trend, increasing by about 615,000 contracts. which was the highest one-day increase before the beginning of April.

Technical Perspective

Price had now busted outside of the wide trading range that they were tending to trade inside until Nov of the previous year. The apex of this range was $83.50 on the 12th of April. It was finally passed over on the first of September Pricing. However, it is currently significantly behind due to an upsurge of advances from the end of August.

Bulls’ attention is going to turn to resistance around $97.82 level. key highest price of the day of the 31st of August of previous year. Shy of a crucial $100 per barrel mark.