EURUSD drops amid the Eurozone weakens. The PMI gives the ECB reason to reconsider it fiscal and monetary policy on further rate hikes

EURUSD Key PMI Considerations

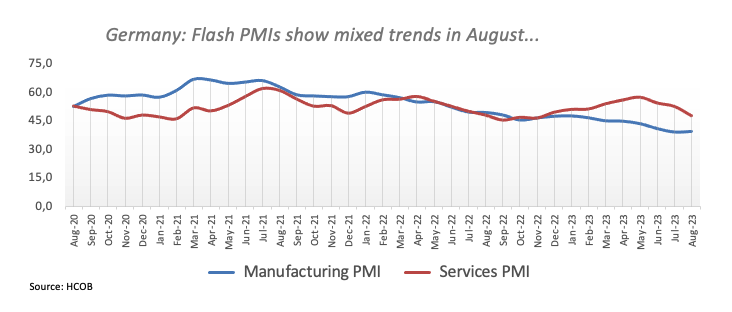

Germany Manufacturers PMI flashed at 39.1, above the projected number of 38.7. Economic Activities Dropped to its lowest level in Nearly Three Years.

Flash Eurozone Composite Output Index to 47 (July: 48.6). Germany’s Service PMI at 47.3, predicted to 51.5. Lowest in thirty-three months.

The Eurozone Service PMI Growth Index is now at 48.3 ( for -July: 50.9). Lower during the last thirty months.

The flash Eurozone Manufacturing PMI is 43.7 (compared to 42.7 during July). Three-month peak.

Informal differences amongst (ECB) members of the Council have developed. Upon the idea of continuing of hardening steps over the summer break. These tensions are adding to a fresh perception of vulnerability, which is harming the Euro currency

After poor German and EU PMI data, the EURUSD falls under 1.0850.

EURUSD pair fell beneath downward momentum and fell under 1.0850 for the first time until the middle of June. According to statistics from Germany as well as the EU, the Services PMI dipped under 50 in August. Impacting severely the value of the Euro. The spotlight is now on US PMI figures.

German corporate activity fell at its fastest rate in three years. After a weak manufacturing PMI was joined by a continued downturn in service output. The services area is especially worrying since it was touted as a possible rescuing light for the German economy. Yet those dreams are currently dashed. Corporations stay gloomy about the remainder of the year. Given a poll indicating an increase in price pressures, mostly due to the service industries.

Source: HCOB. S&P Global PMI

During the month of August, commercial activity in the Eurozone decreased at a rapid rate. Particularly service in being an issue of worry. Service and manufacturers both showed declining sales and order volume, though manufacturing experiencing the worst reduction.

According to a provisional projection, the adjusted for seasonality HCOB Flash Eurozone PMI Composite PMI dropped to 47.0 in August. Versus 48.6 the month prior, which was considerably under market forecasts of 48.5 estimate. The most recent estimate indicated that the area’s commercial activity contracted at the fastest rate until November of 2020.

The PMI Implications

Since reaching a high of 47.3 & 48.8 in January of this year. The German and Eurozone PMI readings have been steadily declining. This can be troubling since a reading beneath 50 indicates that the economy had been in contractionary mode for the whole year. Particularly Germany in being a source of worry.

The remainder of this week offers nothing for the purpose of risk instances. Aside from the Jackson Hole Colloquium taking front stage. Christine Lagarde will be giving remarks, and this may provide greater clarity of the Central The bank’s position

Within the eurozone, flash PMIs in German plus the rest of the eurozone indicated slight gains in manufacturing activity but. Though, continued stagnation in the service industry.

The EURUSD Initial Response and technical Perspective

The first reaction to the news witnessed EURUSD drop 50 pips prior holding at 1.0820 mark. The 200-day MA is now just shy of the 1.0800 level, which might limit further declines.

The EURUSD was under selling stress due to the firmer US dollar and increasing US rates caused the duo drop to support near 1.0840. Reaching a new seven-week bottom. A drop under the 1.0840 supporting level could unlock the door to a move towards the 200-day MA. Which is barely a bit beneath the 1.0800 level.