European stocks rise and Crude oil dips as U.K. jobs data helped. The U.K. market figures were strong, which supported the European stock markets trade slightly higher on Tuesday. However, gains are limited due to caution ahead of the release of the much anticipated U.S. inflation figures.

European stocks today

At 03:35 ET, the FTSE 100 in the UK rose 0.4 percent, the DAX in Germany climbed 0.3 percent, and the CAC 40 in France increased by 0.3 percent (08:35 GMT).

Tuesday’s mood was set by the release of data that demonstrated how resilient the UK labor market remained in the face of the nation’s economic difficulties.

The jobless rate stayed at 3.7% in the 3 months before Dec, and in Jan, rather than climbing by over 18,000 as expected, fewer people than expected filed for benefits, by roughly 13,000 persons.

European stock markets mull BOE

The Bank of England was concerned about inflationary pressures as basic wage increases in Britain soared once more during the final three months of 2022.

Markets will keenly scrutinize the January U.S. consumer price index late on Tuesday to get a sense of how many additional interest rate increases the Federal Reserve will approve this year. Therefore, inflation shall likewise be the main topic of discussion in Europe.

When interest rates reach their highest point, the revised GDP statement for the Eurozone is expected to affirm quarterly growth of 0.1 percent in the fourth quarter of 2022, resulting in annual growth of 1.9 percent.

In the realm of business, Coca-Cola HBC (LON: The stock of CCH) climbed by more than 3 percent after the London-listed bottling giant posted a better-than-expected operating profit for 2022, helped by pricing rises as well as cost-cutting efforts.

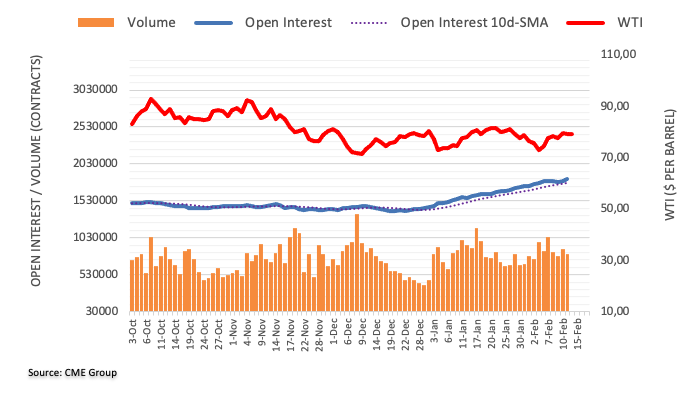

Crude oil falls in European session

After the US government unexpectedly declared late on Monday that it will release more crude from its strategic reserve, oil prices fell on Tuesday.

This might sell 26 million barrels in 2022, according to the U.S. Department of Energy, defying expectations that a similar move would be delayed or abandoned after releasing a record 180 million barrels.

By 0730 GMT, the price of Brent crude futures had decreased by 43 cents, or 0.5%, to $86.18 a barrel, whereas the price of U.S. crude futures had fallen by 71 cents, or 0.89%, to $79.43 a barrel.

Just after the previous session ended, the U.S. Department of Energy (DOE) declared that it will discharge 26 million barrels of oil from the Strategic Petroleum Reserve (SPR), which would probably trigger the reserve to drop to its lowest point as in 1983.