Crude oil remains dominant. Despite a weaker US dollar. With the WTI futures contract trading over 77 USD and the Brent contract trading above 83.50 USD, crude oil has maintained its previous rises.

As a result of the assumption that Federal Reserve Chairman Jerome Powell was not sufficiently aggressive in his remarks overnight, risk markets were largely upbeat heading into the Asian session.

While equity and currency markets appears to be mocking the Fed’s play, interest rate markets appear to be taking his remarks to heart.

Crude oil Takes a ‘Turkey and Forex’ rate affect.

Supply chain problems that occurred in Turkey as a result of the earthquake and in Norway as a result of a technical issue helped oil prices rise even more.

Additionally, the American Petroleum Institute (API) inventory statistics revealed a 2.18million barrel decline in place of the build of a comparable volume that was predicted for the previous week.

The Asian session has seen virtually little activity on the foreign exchange markets following a volatile US session in which the dollar crash all across board. The main winners were the Australian Dollar and the Japanese Yen.

WTI: It looks like the 2023 low will be tested again.

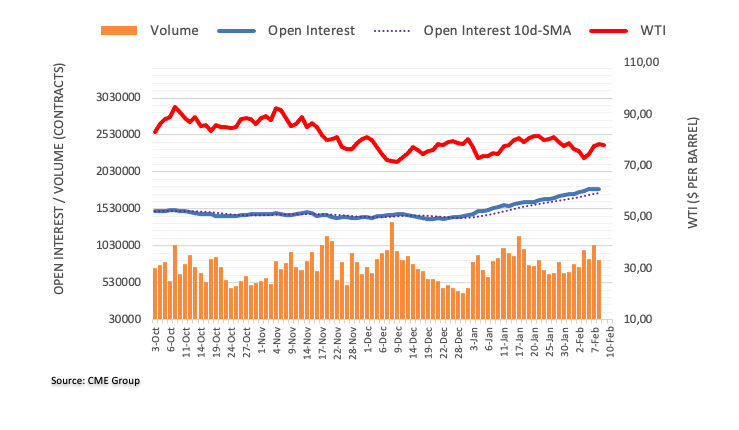

According to CME Group’s flash statistics for crude oil futures markets, investors increased their open interest holdings by almost 4.3K contracts on Wednesday, turning around at the prior day’s decline and restarting the upswing while simultaneously time.

Instead, volume continued its unstable behavior and decreased by about 201.1K contracts. On Wednesday, the price of a barrel of WTI increased even more, crossing the $78.00 threshold.

Rising open interest helped to support the increase, and opens the possibility of this upswing continuing in the very near future.

However, the sharp reduction in volume raises some concerns and may lead to a correcting drop, with the YTD bottom near $72.00 being the next target (Feb 6).