Highlights

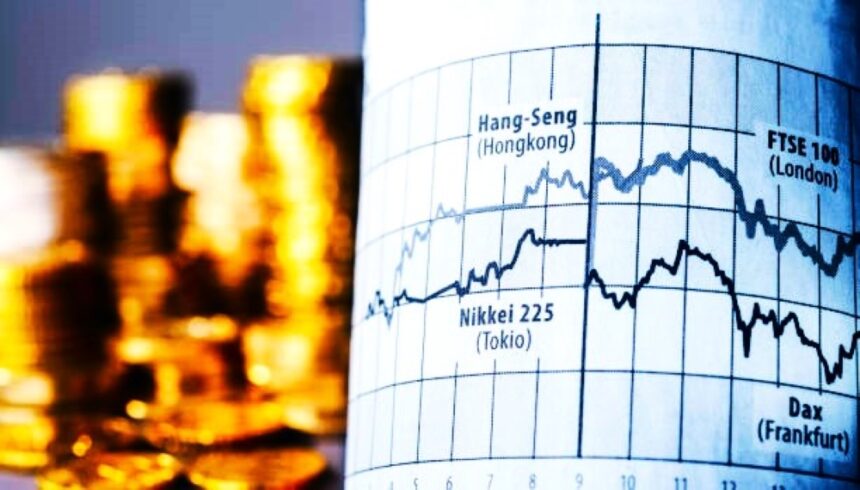

On the third day, Asian stocks experienced an uneven early in the day. Including the Nikkei 225 defying the overall market direction. Hang Seng remained mixed.

Commodities price patterns and Australia’s inflation numbers influenced investor appetite for ASX 200 equities, whereas a lower Japanese boosted the Nikkei index.

Yet, the US futures exchange showed an uneven morning as traders await the highly important American Private Earnings and Expenditures Data.

Yesterday, the US technology area rebounded.

American equities markets experienced more uneven afternoon on Tues. The Nasdaq 100 Index rose 1.26 percent, while the S&P 500 increased by 0.39 percent. Nevertheless, the DJIA defied the overall pattern and fell by 0.76 percent. NVIDIA recovered Mon’s distortions, rising 6.76 percent to $126.09, snapping a 3 day declining run.

American consumer trust makes the Federal Reserve’s rate outlook unclear.

The talk about the United States labor market underscored the uncertainties about salary increases. Intake, and prices. Particularly, the index’s value last dropped under 90 in January of 2021. The nation’s jobless rate was 6.3 percent in January of that year, dropping to 4.0 percent in May of 2024.

Image Source: US Conference board (CB)

This Wed, the 26th of June futures for the US indicated an additional uneven day. The DJIA mini fell by seventeen pts. whereas the Nasdaq 100 mini & S&P 500-mini rose by 28 and three points, accordingly.

Trading concerns hampered interest from buyers in the Hang Seng with Chinese specific equities as US stock futures pointed to a volatile day.

Hang Seng Outlook

The index of Hang Seng fell by 0.04 percent on the morning of Wednesday. Market concerns across talks with Europe & Beijing on levies eclipsed technology market advances.

During the week European Union and Beijing will talk about European duties on electric automobile importation from Beijing. As reported by the Chinese official news channels, China has asked Europe to cancel its intention to impose levies. Concern over both parties achieving a deal put stresses on Chinese equities in specifically.

The Hang Seng Technology Composite rose by 0.54 percent. Baidu increased by 0.81 percent, whereas Alibaba with Tencent gained 0.28 percent and 0.26 percent, correspondingly.

The Nikkei 225 Surges on Technology Comeback and JPY Battles

On the morning of Wed, the Nikkei Composite rose 1.28 percent, due to the USDJPY pushing demand from buyers for export. Today, the pair rose 0.1 percent to 159.825. Night advances in America’s technology industry boosted Nikkei 225 technology shares.

The Tokyo Electron Limited. rose 2.73 percent, while Softbank Corporation gained 1.28 percent.

The ASX 200 index falls on RBA increase in rates & commodities trends in prices.

The ASX 200 index fell 1.01 percent on Wed. Higher-than-expected Aussie inflation figures. That bolstered speculation for an RBA rate rise in Aug. The month the Consumer Price Index indicator rose by 3.6 percent to 4.0 percent in May as well. Analysts predict a rate of inflation of 3.8 percent.

Inflation caused by consumer prices is frequently influenced by products with rapid price swings. Such as automobile gasoline, veggies and fruits, and vacation trips. It is useful to subtract such costs from the overall CPI to obtain a perspective of deeper inflation. That was 4.0 percent in the month of May a decrease from a reading of 4.1 in Apr.

US Stock Indices

The S&P 500 Index had a middling efficiency, with technology rises countered by property and commodities decreases.

The Nasdaq 100 gains 1 percent, driven by technological bigs and Nvidia jump that improves semiconductor category success.

The DJIA falls from its a month’s top, driven by Home Depot’s with Walmart’s dips.

The S&P 500 index had a mixed performance on the previous day, via just two among its eleven industry sectors adding traction. The technology sector headed the way. Including Nvidia up more than 5 percent as the data service benchmark lifted by Alphabet along with Meta Platforms in particular. Nevertheless, the real property and commodities categories drove the overall index lower, falling 1.3 percent and 1.2 percent, accordingly. Investors remained focused on strategy prior towards the important PCE info anticipated late during the week.

Source: TradingView (Four-hourly Plotting)

The S&P 500 has supporting around 5,450.9- 5,440.7 with barrier around 5,520 to 5,530.61. The price index is marginally over its 50 D-MA of 5,471.1, signifying an upward trajectory. The RSI shows flat to an upward trend. The present-day price shift shows stability inside these regions. Considering current price movements, the 50 D-MA is an important measure of trader mood. In light of the present market conditions, the gauge stands on crucial crossroads.