The US dollar is projected to keep stretching its teeth versus its peers. And the current dramatic surge in yields on treasuries could persist. While the US Fed’s officials are expected to underline the need for the Fed to be careful about reducing interest rates prematurely.

Should last week’s sequence holds, US Fed people scheduled for the next few days “may seem aggressive. In order to attempt to create light among their own while Powell’s language in March. This Macquarie stated in a point out. Incorporating that there could be opportunity for the US dollar’s value to consolidate next to the increase in yields in the US setting onto the final consumer the rate of inflation data due Wed.

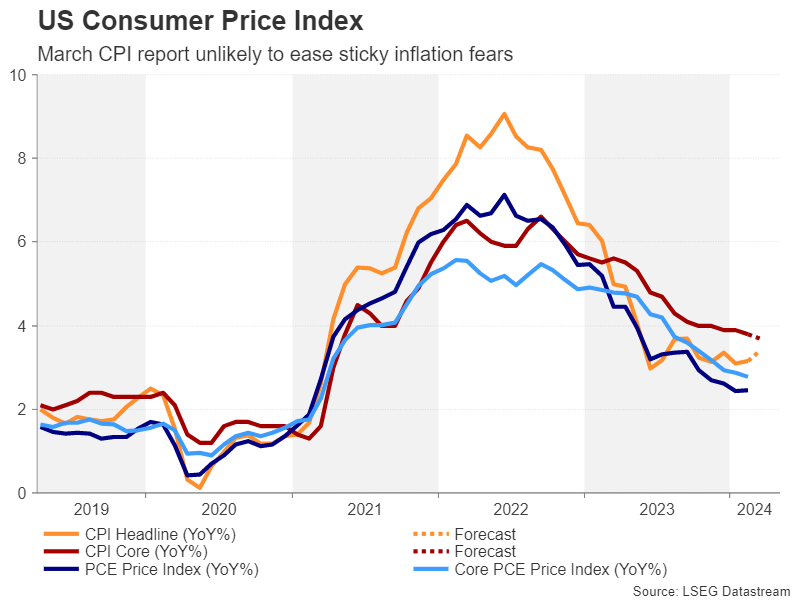

US CPI Forecast

We expect a 0.29 percent increase in core CPI, citing rising energy (+0.7% percent) & foodstuff (+0.2 percent) costs. Our predictions would reduce YoY percentages to 3.70 percent for the primary index. As well as 3.37 percent for the overall, – Goldman Sachs wrote in a memo.

US Fed presenters might draw attention to the expense of a ‘earlier reduce,’ said Macquarie. But they might additionally refer to the likelihood of how the US Fed’s forecasts of the nation’s equilibrium policy might have to be revised higher.

Source: Datastream

This past week, FOMC presenters warned against reducing rates prematurely. Including Minneapolis Fed’s Kashkari drawing attention for proposing no interest rate reduction during the year if inflation continues to trend laterally instead of downward.

US Economic Fundamentals

New statements from US Fed members are expected shortly after the most recent inflation for consumer figure. Along with the Federal Reserve’s March minutes of meetings are revealed on Wed.

In the meantime, the EUR may come under threat by an increasingly dovish European monetary authority. The European Central Bank gathers Thursday. With certain observers believing that it could be a prospect, if modest, of reductions in rates.

Daily Technical Indicators & Signals

Pivots

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

| Classic | 104.08 | 104.1 | 104.2 | 104.11 | 104.11 | 104.12 | 104.13 |

| Fibonacci | 104.1 | 104.1 | 104.10 | 104.11 | 104.12 | 104.120 | 104.12 |

| Camarilla | 104.11 | 104.11 | 104.10 | 104.11 | 104.12 | 104.120 | 104.12 |

| Woodie’s | 104.08 | 104.1 | 104.10 | 104.11 | 104.11 | 104.12 | 104.13 |

| DeMark’s | – | – | 104.1 | 104.11 | 104.12 |

Daily Technical Indicators

| Name | Value | Action |

| RSI(14) | 37.296 | Sell* |

| STOCH(9,6) | 14.196 | Oversold*Caution |

| STOCHRSI(14) | 1.443 | Oversold* |

| MACD(12,26) | -0.05 | Sell*Caution |

| ADX(14) | 36.701 | Sell |

| Williams %R | -94.261 | Oversold*Caution |

| CCI(14) | -85.0293 | Sell* |

| ATR(14) | 0.0609 | Less Volatility* |

| Highs/Lows(14) | -0.0417 | Sell* |

| Ultimate Oscillator | 50.645 | Neutral |

| ROC | -0.205 | Sell |

Bull/Bear Power(13) |

-0.109 | Sell |