The US dollar (DXY) has declined somewhat, citing market responses to the US job market statistics. Notably a 140K increase in ADP Non (NFP) Changes vs an expected 149K, plus the Federal Reserve Chair’s comments.

The Euro experienced a significant drop in Germany’s Factory Output of -11.38 percent. Which is considerably less than the -6.0 percent prediction. Whereas Sterling exhibited resiliency by posting 0.4 percent growth in Halifax HPI m over m, but below the 0.8 percent projection.

Highlights

The US DXYs slight fall highlights investor concern prior of important American data reports and US Fed remarks.

The EURUSD’s minor upward momentum will be tested by the next ECB rate announcement. Which is an important development that might either boost or reverse its course.

The GBPUSD pair’s steadiness over its pivot mark suggests latent confidence. But incoming economic statistics and monetary policy inputs are critical to its brief- term trajectory.

Upcoming events include the expected 217K US jobless claims and Powell’s next hearing. The final act develops to Friday’s news. The mean hourly earnings are likely to rise by 0.2 percent, NFP will increase by 198K versus 353K. mark while the rate of joblessness will remain at 3.7% for the month

The ECB’s policy decisions and strategy pronouncements have a significant impact on the euro vs USD. An aggressive or softer outlook might boost or weaken the EUR.

US DXY Outlook

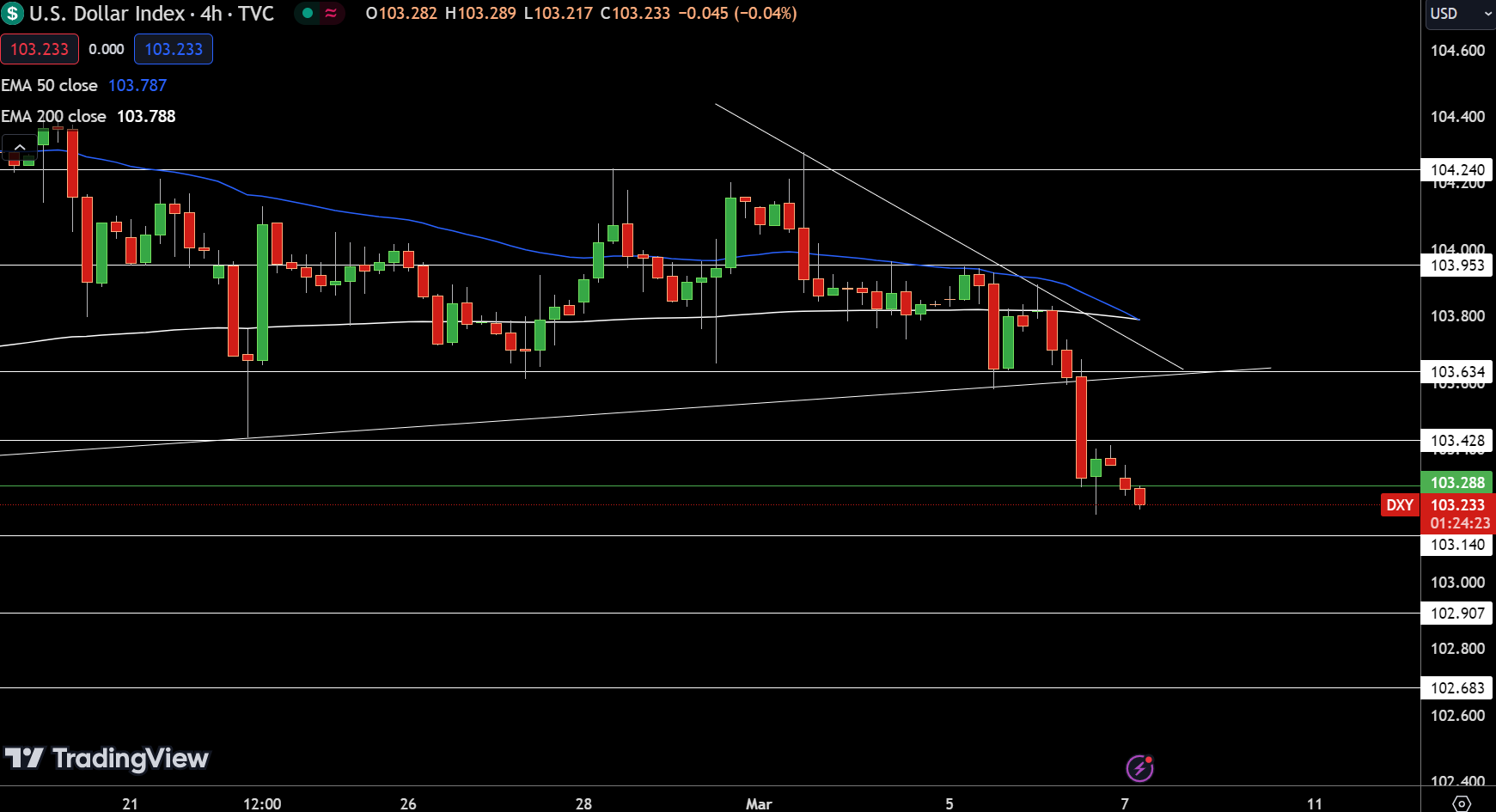

Source: TadingView – Daily graph

The DXY is in a minor downturn right now, dropping 0.08 percent to 103.233 level. Highlighting modest but current market concerns. The benchmark index is currently trading inside a close spectrum, slightly under its pivot mark of 103.288. It meets instant opposition at 103.428. While following obstacles at 103.634 then 103.953 area likely stifling further upward trend.

In contrast, the underlying support pattern is clearly apparent at 103.140 mark. Continuing to fall to 102.907 and then to 102.683 area. Showing crucial regions wherein investors might appear to halt additional drops.

The 50 & 200 D-EMAs are both sitting at 103.787 & 103.788, correspondingly. Considering these patterns, the US DXY prognosis is moderately negative beneath 103.288 zone.

The EURUSD Technical Outlook

The EURUSD duo rose by 0.02 percent today and is trading at 1.09018mark. Reflecting cautious investor confidence. It is barely over the key barrier of 1.0893, showing that investors are tentatively positive.

Barriers levels of 1.0916, 1.0939, through 1.0963 markers represent probable limits for further growth. Supports occurs around 1.0867 level, having further cushioning around 1.0822 then 1.0796 to cover possible turnarounds.

The 50 & 200 D- EMAs, near 1.0849 & 1.0833, each, support the positive view, if the duo maintains over the pivot region. Nevertheless, a drop under 1.0893 might shift the perspective to negative. Reinforcing the importance of this mark in determining an immediate trend.

The GBPUSD Technical Outlook

The pound’s US dollar pair rose modestly by 0.01 percent to 1.27378 mark. Reflecting moderate confidence amongst investors. The asset has risen above its critical level of 1.2715, showing a possible positive connotation in the present market fundamentals.

The resistance levels are vividly noted around 1.2758, 1.2783, then 1.2807 level. That may act as caps for any further rise in prices. In contrast, the duo sees immediate refuge around 1.2673 mark. Having more safeguards around 1.2647 & 1.2600 poised to absorb any slumps.

The 50 & 200 D-EMAs, which sit at 1.2682 & 1.2655, accordingly, confirm the positive picture. For so long as the exchange rate stays higher than the pivot point.

Trends Vs US dollar

EURUSD – Bullish

GBPUSD – Bullish