Wall Street Shares in the United States look to be adequately poised to break new tops in the next year. Prospective US Fed rate decreases in the subsequent part of the fiscal year. Lowering inflation rates, and increased business revenue rise are all positive triggers. We feel 5 K mark is a reasonable the end of the year 2024 price goal for the S&P 500, while in this setting, investors prefer growth companies than values.

Considering the greatly expected onset of a slump in 1H the year 2024, We’re optimistic that that US stocks in the Wall Street will cope with a slight economic slump. Due to our projections of lesser interest rates and related revenue velocity in 2nd H of 2024. As well as the severe decreases equity markets experienced in the year 2022 along with -still struggling to recoup from.

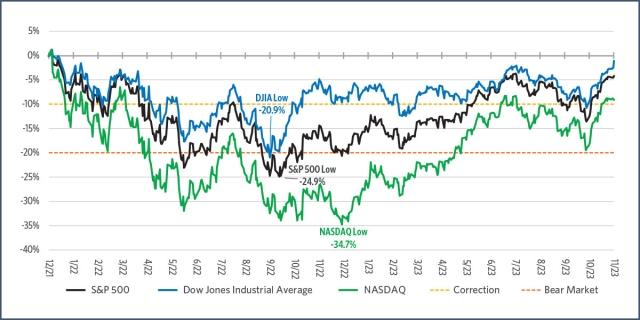

The Ups & Down journey on Wall Street

The main indices of stocks on Wall Street are on an up-and-down ride. While they pursue an entire downturn comeback.

Bloomberg is the source. As for: 11/30/23

Note: Indices aren’t overseen, and investors cannot make investments actively in them. Prior outcomes are not indicative of future outcomes.

We believe that 5 thousand is a credible S&P 500 the end of the year 2024 value forecast. Which fueled by possibly higher business profit expansion, lowering basic inflation prices. Including the conclusion of the US Fed’s tightened phase along with anticipated rate reduction in 2nd Half of 2024. All of these variables ought to act as significant drivers for the value of stocks in the coming year.

After an almost stagnant year for profits expansion in current year 2023. The S&P 500 net operating revenue could rise in the following year. Regardless of whether a small downturn occurs in 1st Half of 2024. We anticipate the S&P 500 net revenue can expand by more than 10% in 2024. But this will be reverse weighed having business earnings growing greater in the latter part of the year. While the economy recovers from a projected slowdown in growth in both of the initial quarters of next year.

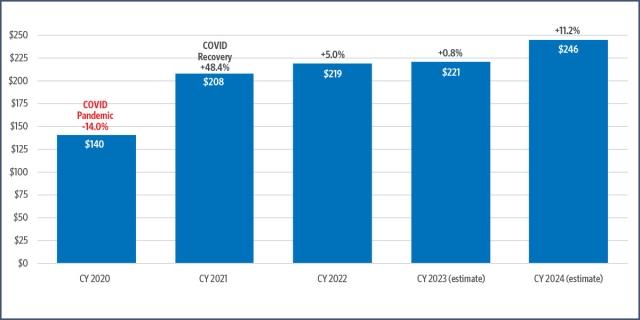

Earnings increase in corporations

Net operating revenue in the S&P 500 is expected to rise at the fastest rate after the outbreak ended.

Chart Source: FactSet Earnings Insight 17th Nov. 2023

Analysts believe that aggregate market values are appropriate provided chances for increased revenue growth. Versus a background of lowering pricing and fewer restricted US Federal monetary policies. Analysts predict that the S&P 500’s net operating revenue will be roughly $250 in fiscal year 2024. Following an increase in earnings of double-digits following in fiscal year 2025. As a result, we anticipate revenues in the year 2025 to come in around the $275-$280 assortment. Along with given the anticipated falling inflation along with the Federal Reserve. rate reductions. We think it’s the appropriate price revenues ahead several on the CY the year 2025 earnings to prove 18 times. Suggesting a potential end of the year 2024 price spectrum of $4,950 to 5,040, with the halfway point of 5,000 mark.

Summary

The financial sector starts its next year on the tailwind of a great the year 2023. The Nasdaq 100 index is on pace to finish the year with a 6th-best yearly result. Before falling 33.1 percent in the year 2022, The revival was particularly gratifying. Putting the year 2020 43.6 percent increase into consideration, the Nasdaq Composite is currently on track to enjoy 2 of its greatest six-year spans in record in this present ten years.

The S&P 500 has been put on course to gain 22 percent in the year 2023. And represents roughly twice the average past yearly returns. Additionally, it recovered well after a 19.4 percent drop in the year 2022.

The Wall Street believes that the Federal Reserve will achieve its aim of a gentle touchdown for America’s economy. Which predicts weaker growth in the economy yet neither a downturn, resulting in rate decreases in the year 2024.

Most experts predict stronger corporate profits growth for S&P 500 corporations in this scenario. In terms of what the S&P 500 might fare in the approaching electoral year. Projections for 2024 vicinity significantly, though the general opinion appears to be in the area of 8- 9+ percent improvements. Which is slightly lower than the indies historic median of around ten percent.