The price of WTI oil surged on Tuesday, with the Brent standard breaking over $80/bbl. amid anticipation from the OPEC+ producing club will tighten and prolong supply cutbacks. In response to concerns about weaker demand around the world.

The Organization OPEC and its partner countries, including Moscow, will host a video cabinet summit on Thursday to debate 2024 goals for output.

Reaching 0921 GMT, Brent crude prices traded up 72 0.9 percent, at $80.70/ barrel. The (WTI) crude oil futures in the United States rose 69 cents, or 0.9 percent, to $75.55.bbl.

WTI Crude Key Points

WTI Crude Oil has recovered from its minimums and is trading at $75 on Tuesday.

The dollar’s value remains flat, trying to keep its top over waters in order to arrest the current fall.

Crude might fall if API data show a further increase in stocks in the US.

Notwithstanding the downbeat mood lately in news stories. prices for oil are away from their lows today, leaving the recent result in the black. The Palestine truce was recently extended by a second day to allow for further detainee swaps and essential deliveries. Furthermore, speculators have altered their posture on OPEC+ inner splits. Amid tensions rising ahead of Thursday’s summit with a probable response that might send oil upward.

The USD is also above its lows for this month, as investors from the US are back to their usual working pattern. The US dollar is attempting to recover from yesterday’s falls but is slightly up in an uncertain situation. Having no fewer than 5 Fed speakers scheduled for remarks. Investors are going to be looking to identify clues about the US Fed’s future action in Dec.

A weaker US dollar, making oil lower for owners of foreign FX assets. As well as appears to represent higher risk tolerance amongst buyers. That also helped crude oil, as did forecasts that American crude stocks fell this past week.

According to Reuters polling experts, the current batch of every week United States supplies data will result in crude stockpiles falling by roughly two M barrels.

WTI Technical Analysis & Perspective

The price of oil might have hit the bottom of the present decline. The squeeze on prices is increasing prior to Thurs OPEC+ vote. The American Petroleum Institute’s stockpile data are likely to indicate a reduction in inventories for the initial occasion in Nov. This might suggest that US output has hit its limitations for this moment in being meaning need will rise anew across the worldwide Crude markets. Whereas OPEC+ works to bolster its delivery.

The Bull Scenario

To the upward trajectory, $80.00 mark becomes the key obstacle to monitor. If oil can break over this point, anticipate $84.00. Being the next significant level that signals some pressure to sell or reward taking. If the price of oil is able to hold over that level, the upper limit for this decline on $93.00 may become relevant again.

The Bearish Scenario

For the negative side, investors are observing the formation of a weak base at $74.00 mark. This mark serves as the final point of security prior to hitting the $70.00 and below range. Keep an eye towards $67.00 mark to be the next support zone to speculate at, which is the triple in nature low base since June.

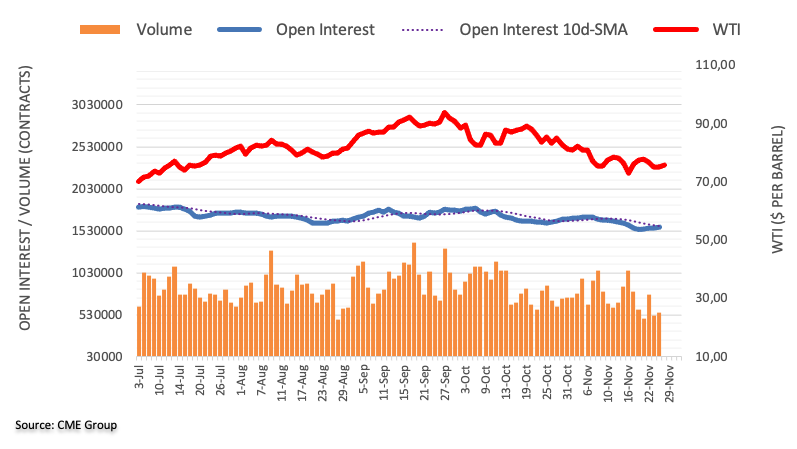

Open Interest Positioning

At the start of the week, open interest across the oil futures exchanges grew for the 4th consecutive period. reaching roughly 4500 contracts. Volume continued accordingly, increasing by roughly 41,500 agreements despite the recent unstable trend.