The market for bonds is returning to the news following global rates fell yesterday. Following the publication of inflation in the US data.

Although the US the Consumer Price Index data released Tuesday. Revealed the two figures dropping 0.1 percent under estimates. The impact on the US government bond market and the currency was significant.

The bond yield for the rate-specific US -Treasury 2-years dropped by 20 bps to 4.85 percent on the day. the United States Treasury a ten- fell by 18 bps. And the US Treasury 30-years declined by 15 bps. The impact on the United States greenback was significant, resulting in the dollar shedding almost 1.5 points during the day.

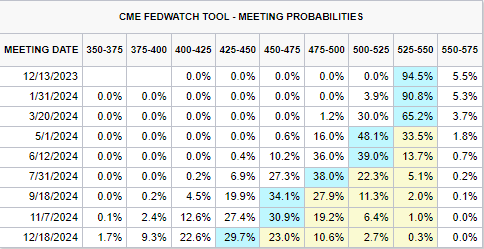

The most recent CME Fed Funds forecasts 100 bp decreases in rates through 2024. Including a primary 25 bps drop projected during the May FOMC conference.

The CME Fed Tool Chart

Lower anticipations for interest rates are growing not only in the United States. But additionally in the United Kingdom and the European Union. Which have both announced substantial rate reductions for the coming year. The present-day inflation data for the UK statistics revealed overall inflation falling drastically to 4.6 per cent in Oct. according to estimates by the Bank of England senior analyst Huw Pill lately down 6.7 percent in Sept.

According to British rate forecasts for the coming year. a preliminary 25 basis point drop will occur in June. Followed by 2 subsequent .25 point decreases in the H2 for the calendar year.

Risk institutions become more enticing now that market participants are constantly factoring in inflationary decreases. Investor wishing to put their cash to use in more volatile investments. Which have fueled current developments in a variety of equities markets, so this pattern is expected to keep going in the weeks and months ahead.