WTI (US Crude Futures Oil) falls beneath $80 despite Saudi Arabia and Moscow reiterating production restrictions.

US Crude WTI oil has dropped to a 3-month trough. Notwithstanding an immediate fall, the value of the American dollar remains over 105.00 zone. Crude is at risk of plummeting below $78.barrel, its final point of protection prior to sliding below $70.

The prices of oil are falling amid S. Arabia and Moscow reaffirming that production curbs would continue through Dec. Investors were no longer astonished by the revelation because it is outdated news, sending oil prices even lower. Since China export figures reflect an important decline and decreased demand for the region’s largest Asian Oil importer. The price of crude has reached a fresh 3-month bottom and may fall lower in the present environment.

In the meantime, the USD sank significantly this past week, bringing the summer surge to a close. Many US economic data points are beginning to flare red in color. Showing that the country’s economy is struggling to deal with the rising interest rate climate. At this point, American expenditure is skyrocketing as Joe Biden, the US president, pledges millions not solely to Ukraine, as well as to Israel. Raising the United States Treasury’s burden of debt.

WTI Crude: How far It can fall?

While we navigate the intricacies of the month’s market waves, crude stands out not only as an asset, but also like a writer. Who is conveying a tale of profound market upheavals. This most recent episode depicts an event situated at the bottom of the market after the end of summertime. Both technical as well as fundamental components collaborating to write a negative narrative.

The difficult landscape is denoted by a traditional head and shoulder design, carved in a vivid mauve on the graphs. The neckline’s violation confirmed the design’s likelihood of reversion from earlier advancements. Validating its status as a traditional precursor of gloomy woes. Once prices fell below this important the intersection, it signaled a definite break out of the bullish’ previous position.

The value for crude oil strove to conquer the tall barrier of opposition at 88 dollars, – On a bid to reclaim its previous grandeur. The next check on the neck-line, already a bear-drawn slash in the dirt. witnessed it remain fast, creating a larger shade across the route forward.

WTI Open Interest Positioning & Technical View

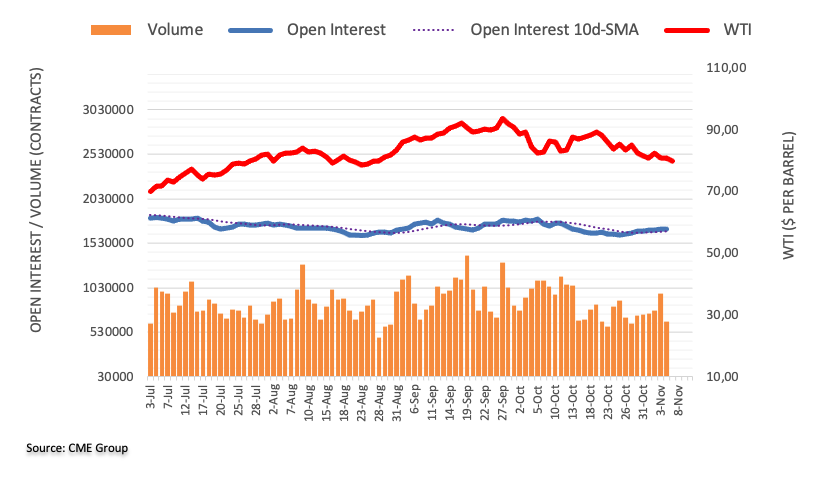

Based on early CME Group data, market interest in the oil futures exchanges fell by roughly 14,000 deals on yesterday. Prolonging the unstable activity witnessed recently. Following 5 successive daily increases, volumes fell by approximately 313K futures contracts.

WTI Crude pricing increased slightly on Monday, closing barely above the $80.00 / barrel threshold. Yet, the decline was driven by declining market interest & amount. Putting the asset exposed to more deterioration in its immediate future. However, the following point of conflict is the 200-day simple moving average, which is now around $78.15 critical level.

Support & Resistance