Investors expecting a fantastic swing upward trend in the GBPUSD. That is maintained and continuing to build traction for a period of time were undoubtedly frustrated anew this past week. While the US dollar retains a genuine level of endurance. Scalpers tend to seek out the GBPUSD to be an asset class that correlates to the broader Fx market.

GBPUSD may see higher VIX

The GBPUSD entered the weekend’s trading at the 1.21175 stage, A day after touching the 1.20690 rate. The Pair continues to be capable to regularly trade over the 1.20000 threshold. So it’s probably regarded as a key psychological threshold by the banking sector. On October 4, the pair ratio temporarily hovered at 1.20375. The battle at the lowest points also leads to greater reverse transactions. Something investors are attempting to exploit on higher rises.

This week’s top for the exchange rate, the pair was achieved on Tuesday, with the currency pairing reached about 1.22890 mark. just after that falling anew. The GBPUSD finish on Friday was unquestionably inside the range of the duo’s lows for the week prior and Oct. Given worldwide concerns and economic worries for institutions of finance. Behavioral mindset continues unstable. Resulting in a significant level of ambiguity and a deficiency of risk tolerance.

The Fed of the United States and the BoE The following week

investors should be mindful that the central banks will be issuing interest rate decisions on Midweek and Thurs. These banks are anticipated to maintain their benchmark funding rates. The Federal Reserve’s tone on Wed will likely be significant and might make an impact.

The United States is consistently releasing statistics that demonstrates that US consumers continue to pay. The British economy has provided disappointing facts, while it additionally revealed signals of somewhat greater prosperity than expected.

While the US Federal Reserve is unlikely to increase the federal funds rate next week. Officials is likely to keep trying to appear aggressive, informing banks that rates of interest will stay high. With the possibility of a further rise persists. The Bank of England is expected to adopt an extra dovish voice, that might make GBPUSD speculators concerned. The pair is now trading at a low point that many believe are under-valued. Although projecting whether a strong move upward will occur is hard since financial institutions maintain apprehensive internationally.

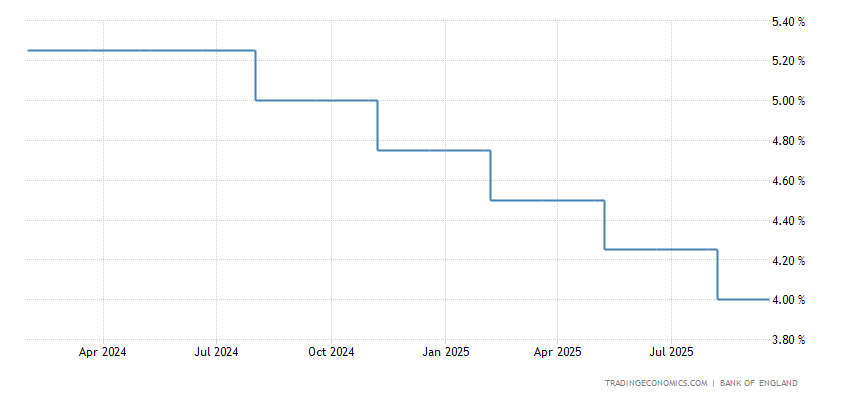

UK Interest Rate Graph

Source: TRADINGECONOMICS.COMTechnical Analysis and Perspective

- This 1.20000 Threshold is still visible, however can have to unroll and result in a response?

- As the British pound against the US dollar trades at a month’s lowest points. it is additionally approaching levels reached at the start of the current year. investors may wish to bet on higher movement, but this can be extremely risky.

- The week ahead is expected to see greater anxiety in trading purposes that is likely to result in bumpy circumstances.

- Technicians may be expecting a further drop in the pair to determine whether support might be found at the 1.20000 metrics. followed by expect a bounce higher.

- Yet, if world markets abruptly become more cautious, behavioral attitude might result in a greater hazardous pricing velocities.

GBPUSD Weekly Prospects: The pair speculated range of prices is 1.20125 through 1.22990 ratio.

The move lower in the duo keeps going, and investors seeking for additional downward activity can’t be faulted. However, for the two currencies to trade substantially reduced. A further injection of bad news in the world’s markets will probably be required. Rendering the US dollar an excellent security choice. Should this is not the case and traders stay calm and careful. the pair may display lumpy outcomes with normal turnarounds. Because institutions of finance attempt to negotiate till favorable conditions prevail.

Although it could be enticing to assume that the British pound to USD has been exhausted that will soon begin to rise. Forecasting whether this period will turn into a sustainable pattern stays subjective. Dealers of this pair ought to keep their aims in check, especially if they’re short-term investors. Having a restricted number of trading accounts. The simultaneous actions of the US Fed and the Bank of England, as well as additional worldwide developments including market volatility. It might lead to a more volatile week of activity.