Gold prices rise as US rates fall, despite ongoing concerns in the region of the Middle East. Key Central Banking Decisions on Policy in view

Gold Pricing and Shifts Key Points

The price of gold maintains its comeback, aided by a drop in over- time US government bond rates.

The dollar’s value rose as S&P Global PMIs indicated an increase in American economic growth.

Markets are looking forward to the third quarter GDP and the Federal Reserve’s favorite inflation measure. Which might affect the Federal Reserve’s decision in Nov.

With nothing fresh information affecting price movements, gold is holding flat during the initial trade. Notwithstanding the continued situation in the Arabian Peninsula. The. Risky marketplaces are attempting to surge upward as the nation’s earnings period begins. The United States S&P flash index of composite stocks shocked on the upward on Tuesday. Showing that economic growth in America is improving, contributing to the growing consensus of the US is poised for a soft touch down over the months to come.

The United States dollar’s attractiveness grew dramatically when S&P Global announced an increase in US commercial activity in October. Notwithstanding rising rates of interest and several-year peak US yields on bonds. In contrast to Asian plus Eurozone economies. the economy of the United States appears to be coping well with higher borrowing expenses. Caused by healthy spending by consumers, softening pricing stresses, and buoyant labor need.

The US Fed won’t be the only monetary authority on the agenda. Having the European Central Bank, Bank of Canada, BoE, and BoJ each releasing their newest policy choices

Technical Analysis

the price of gold is presently fluctuating on both sides of $1,970 per ounce prior to the US GDP figures. Plus, the Fed’s resolution the following week. A immediate barrier level of about $1,987/oz. stays in place. And the price of gold must close and reopen over here in order to reach $2,000/ troy oz. Then $2,010/ troy oz. Support is indicated at $1,960/oz., with an area spanning $1,940. & $1,932.5. area.

KEY SUPPORT AND RESISTANCE

S3 1810.28 S2 1810.28 S1 1810.28 R1 1997.12 R2 1997.12 R3 2080.07

S3 1810.28 S2 1810.28 S1 1810.28 R1 1997.12 R2 1997.12 R3 2080.07

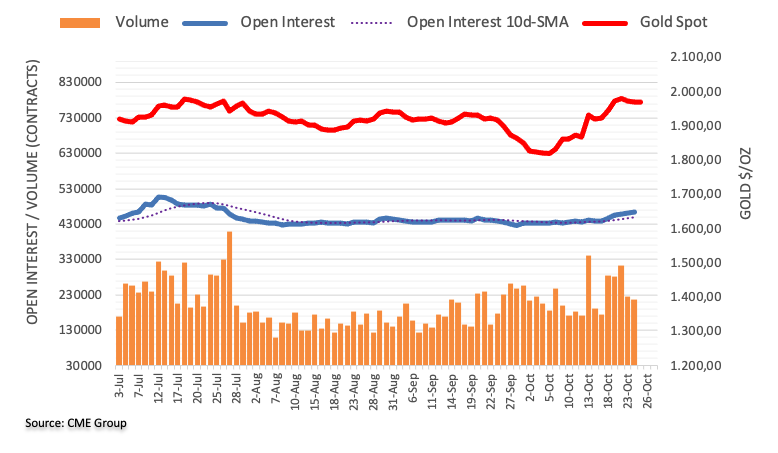

Gold Open Interest Graph & Positioning

Based on early CME Group data, speculation in gold futures trading increased by roughly 1.6K units on Tuesday. Rather, activity fell during the 2nd period in consecutive days, this time by approximately 9000 deals.