Gold saw a price adjustment but recovered to hold firm at $1,980 level. After the prior week’s spectacular gain. The standard a ten- US government debt yield remains positive at 5 percent, keeping further gains in XAUUSD challenging.

- Bond yields in the United States have reached new record levels.

- Gold is preparing for a second push towards $2,000.

Previous Friday, gold attempted to break $2,000 per ounce but failed to sustain the pace. The continuing Middle Eastern turmoil is still fueling the recent gold boom. while safe-haven investors drive up the value of the metal. Notwithstanding rising US bond rates, gold has been restoring near $1,980/oz. As well as seems likely to test it again major number barrier in a few days.

The carefully watched US a ten- benchmark is currently yielding 5.019 percent. The highest rate as of July of 2007. If yields breach over the July 2007 top of 5.29 percent, they will return to rates that occurred at the beginning of 2002.

10 YEAR TREASURY KEY STATISTICS (Oct 23, 2023)

| Actual | Chg | %Chg |

|---|---|---|

| USA | 4.9651 | 0.0411 |

- Yield Open4.959%

- Yield Day High5.021%

- Yield Day Low4.944%

- Yield Prev Close4.924%

- Price91.5938

- Price Change-0.3125

- Price Change %-0.3438%

- Price Prev Close91.9062

- Price Day High91.7656

- Price Day Low91.2031

- Coupon3.875%

- Maturity2033-08-15

Source: TradingView

Key Points and Considerations

- The gold pricing found support at $1,970.00/oz while consumer appetite for security investments continues strong.

- Traders’ attention is shifting to the US the third quarter GDP data, which will offer a backdrop for the Federal Reserve’s interest rate stance.

- Federal Reserve governors are always in favor of keeping rates of interest stable.

Traders will be watching the rise in the rate in the period between July and September. Closely since it is going to establish the mood for the rate of interest at the close of this year. A positive rate of growth suggests healthy labor market dynamics. Significant spending by consumers, and a resurgence in business activity notwithstanding the Fed’s restrictive monetary policies.

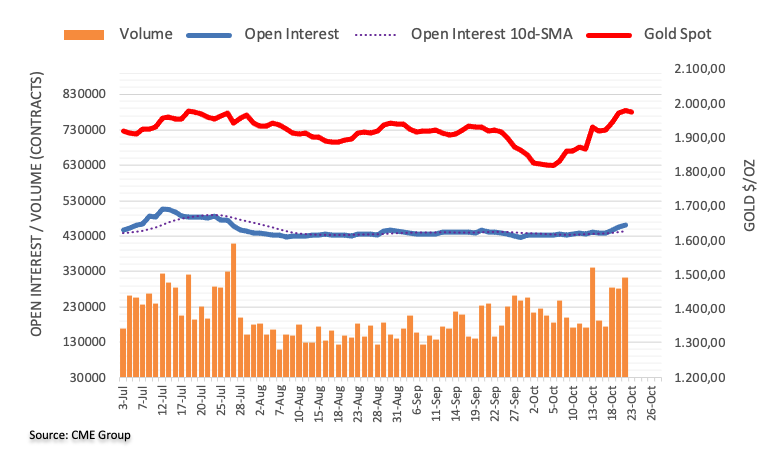

Open Interest Positioning

Based on early CME Group assessments, the amount of open interest in metal contract futures increased for the 4th period in succession. Rising by roughly 5200 units. Volume increased by an additional 30,000 deals, offsetting the prior day’s decline.

Technical Perspective

The price of gold has recovered after a brief dip to about $1,970.00 and is projected to reclaim the 5-month peak of $2 K. For a period of two weeks, the price of gold saw huge rises. A bull cross between the 20 & 50-(D-EMAs) indicates that additional upside is on the way. Velocity indicators enter the positive region, suggesting that upward momentum has been actively engaged.