Gold has surpassed $1,980 as a result of Powell’s remarks. The yield on the 10-year bond has risen to 5 percent.

Gold Prices Key Points

On Friday, the gold prices extend its current upswing and rises to a near 3-month top.

International threats continuing to fuel refuge inflows and encourage the flight.

Rising US bond rates & an upbeat USD could restrict profits in the face of an overheated RSI levels

Gold Markets Taking a Cue from US Bond Yields

The US’s national debt has risen to more than thirty-three bucks trillion, while the security of US government securities. Particularly at the higher end of the curve for yields, has come into examination by foreign investors. Amidst rising tensions in M. East and a quick rush for safety, US 10-year debt was rapidly traded in, and the United States the ten-year price surpassed 5 percent.

Furthermore, the United States is slated to assist Israel as well as to keep helping Ukraine – during a moment of escalating budgetary woes.

In reality, the price on the typical a ten- United States Treasury bond has fallen off a new sixteen-year high reached on Thursday. But it stays near to the 5 percent barrier. It together with an overvalued RSI over hour graphs, calls for optimistic investors to exercise prudence. As well as prepare for any additional appreciation of the USD

Nonetheless, gold is ready to post significant gains for an additional week in a row. While investors await statements from prominent FOMC officials for immediate chances on the final day of the workweek.

The US dollar’s value has been fairly tranquil in the forex market this week. Despite the spike in US rates. Even with rising US rates, safer-haven wealth continues to flood into gold. The value of an ounce surpassed $1980 mark early today. With buying are expected to pick up towards the end of trading as traders seek shelter ahead of closing the week. Which could lead to more bloodshed in Gaza. Oil’s price has risen beyond $90 a barrel & is expected to go up further owing to concerns about supply issues in the region.

Technical Analysis & Perspective

Technically, the current week’s breakout over the 200-day simple moving average and following surge over the $1,947 to 1,948 supplies area. Which promotes optimistic investors. However, the (RSI) on hourly timeframes is indicating overvalued circumstances. Indicating the need of certain short-term stability prior to another wave higher. Nonetheless, the price of gold is prepared to reach the July swinging top, at $1,987 mark. Then seek to break beyond $2,000/oz psychological barrier for its first occasion before the month of May.

On the other hand, any major correction slide currently appears to be seeking solid support. While prospective buyers at the $1,947-1,948 obstacle break. This may restrict the price decline at the 200-day SMA, which is now around $1,930 mark, – A decisive breach beneath, on the other hand, may spark more technical reselling.

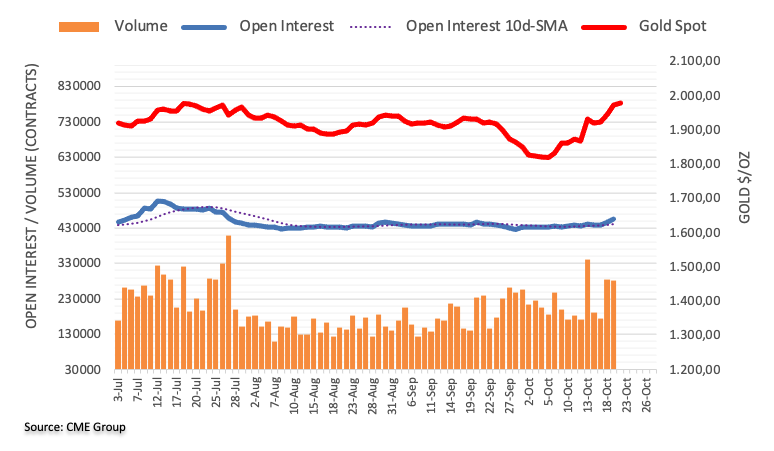

Traders Open Interest Positioning

Based on initial CME Group data. The open interest in gold futures exchanges increased during the 3rd trading day by roughly 9.5K units. Volume, and on the other hand, maintained a downward trajectory and decreased by roughly 2700 agreements after the prior daily rise.