WTI Crude Oil surges after UAE backs OPEC+ supply restrictions in advance of UN Framework Convention on Climate Change COP 28.

The capital markets’ premise during the previous 6-months has proved both easy and hurtful: Severe nearly 30 percent increase in WTI oil prices combined with a significant increase in cost of borrowing. Equals a crashing for world stock markets & bonds.

The subplots involve Saudi Arabia with Moscow reducing crude supply. In addition to 2 African uprisings, but the major subject was the US Fed and company keeping raising rates of interest.

Given this up-for-prolonged span attitude, the US Treasury bond market as well as Germany’s Bunds, Typically the key weight in investments, have lost around 5 percent and 6 per cent. Alongside the majority of the loss occurring in September.

WTI Crude Major Key Points & Considerations

Oil (WTI) rose on Monday, reversing the previous week’s decline.

The United States Dollar remains steady despite stress due to a risk-on market environment.

The path to $94 area is clear, with additional news expected in the aftermath of the Adipec conference.

The US currency wasn’t given ample opportunity to celebrate its 11th consecutive weekly of increases. There was a close contest the previous week, for the (DXY) securing rises in the final hours of trade.

Brent’s nearly 27.25 percent gain was the seventh greatest quarter of the decade. Nonetheless at roughly $95 per barrel, it remains 30 percent less than the price it reached following Russia attacked Ukraine.

Saudi Arabia Modifies its Pricing Approach in Response to Lowering Consumer

The increase in the price of oil to their greatest point in over a year has done marvels for the region’s economy. Saudi Aramco has continued its acquisition of little holdings of privately owned Chinese refineries. Taking advantage of the reality that oil rates have remained over ten dollars per barrel over its assumed financial break-even point,

Authorized prices of sale for Asian Shipments by Saudi Aramco (which is, in comparison to the Oman and Dubai benchmark).

Source: Saudi Aramco

At the moment of typing, Crude Oil (WTI) was trading at $90.359 / barrel while Brent Oil was trading at $92.17 / barrel.

The Saudi Aramco additionally decreased equation pricing for its European clients, with all grades reduced by $0.10 / barrel. In comparison with Sept OSPs across Europe’s northwest and the Mediterranean region. While the tiny rises across Asia were unexpected, investors expected small from month to month drops in the European Union. Wherein spot/cash-traded variances had been declining for many weeks.

WTI Crude Technical Analysis and Perspective

The price of oil is beginning to rebound following a sharp drop on both Thursday and Friday. Since the decline in prices stopped so swiftly, dealers and traders continue to buy the correction. Oil can shortly return to $94 per barrel.

On the bright side, the double-digit peak from previous November and October of $93.12 stays the target to surpass. While it was broken on Thursday, there was no day closing over it. If $93.12 is stripped away, the top for August 20, 2022 is $97.11/barrel level

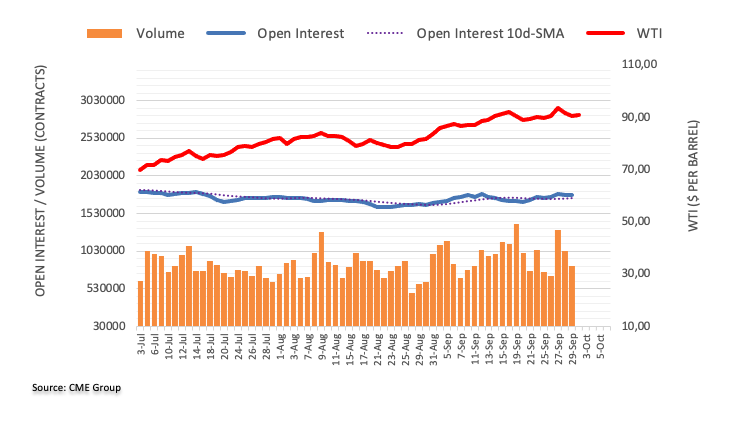

Crude Oil Open Interest Positioning

Based on early CME Group assessments, open interest within the oil futures trading fell for the 2nd afternoon in succession last Friday, Albeit by merely 692 contracts. On the similar vein, volumes fell for yet another consecutive period, this time by about 208.6K transactions.