Euro has recovered to 1.0800. With ECB officials set for their remarks. European stocks begin the workweek on a high track.

Euro Currency Key points on Monday

The Euro’s value has recovered to the 1.0770 level versus the US dollar.

European stocks begin this week on a high tone.

The bullish perspective on the (DXY) appears to be confined at 104.50.

German bonds build to Friday’s gains at the start of the workweek.

Due to the Labor Day vacation, the US markets are scheduled to be shut on Monday.

During July, German’s trade surplus dropped to €15.9 billion.

The EMU Sentix Index will be released on 08:30 GMT.

Christine Lagarde, President of the European Central Bank, will give a speech afterwards in the period.

Euro takes back little traction vs US dollar to begin the week

The Euro reclaims a bit of positive impetus versus the US Greenback. Allowing EURUSD to recapture the region over the crucial 1.0800 mark established during the start of this week.

The US dollar, on the contrary hand, faces some adverse pressure and returns to its previous 104.00 level. Being measured by the USD Index. While traders keep weighing Friday’s mixed report from the US employment data (+187,000 positions).

Several significantly market-moving headlines are scheduled for the Eurozone during the day. Starting with the German report on balance of trading. That revealed exports stalling emphasizing- growth-related worries for the Eurozone’s biggest economy. Since a consequence, the overall amount of trade fell to 15.9 billion euros.

The October summit could represent the ECB’s final option to raise rates in a declining Eurozone economy. Although the market price seems to suggest a delay.

Interest Rate Policy by Fed and ECB in question

Meanwhile, betting for the Fed pausing its rate hike drive for the remainder of the calendar year stay solid. Despite early anticipation of interest rate decreases before March of 2024. Speculation remains elevated at the ECB on a likely rate move over the end of summer. Amid investor buzz of a stagflation

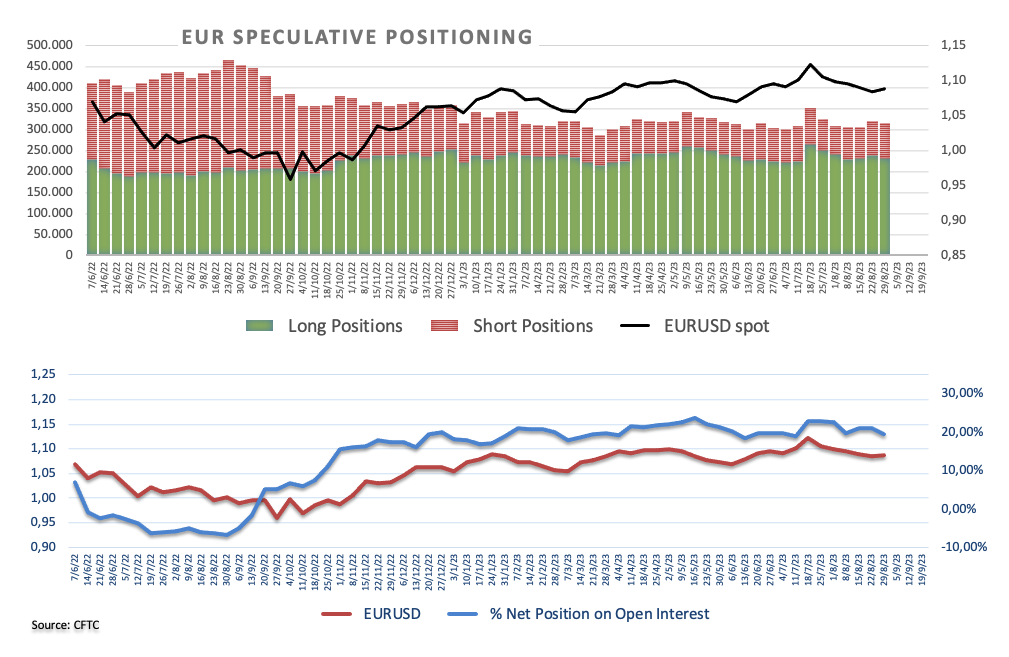

Euro CFTC Trader’s Positioning Data

Based to the CFTC posture data, overall longs in the Euro fell to depths that were last observed in the beginning of July, for the span of time ending the 29th of August.

Source: CFTC

Technical Analysis and Perspective

EURUSD accelerates and retests the 1.0800 zone, just shy of the crucial 200-day SMA of (1.0817) level, The EURUSD duo is likely to rise more and reach the crucial 200-day SMA at 1.0817 mark. Bullish traders ought to surpass previous Wednesday’s high of 1.0945 area. In advance of the intermediate 55-day SMA @ 1.0961, before the psychological 1.1000 hurdle with the monthly peak of 1.1064 zone.

The daily EURUSD trading action stays beneath the psychological level of 1.0800, as sellers chasing the 1.0767 swinging bottom.

Some Views on Near-Term Trend for Monday

The EURUSD pair fell sharply on Friday night, attaining our hoped-for target of 1.0785 level. Noting the fact that its value exceeded that mark and finished the daily candlestick underneath it, Bolstering the likelihood of the negative partiality moving forward in the following period, Opening the path to 1.0700 as the following adverse levels

As a result, we will keep recommending a bearish outlook on an intraday and immediate base. Backed with the downside pressure produced by the EMA-50. Observing that breaking & settling over 1.0785level will cause price action to begin comeback measures which will first aim 1.0785 regions.