WTI crude oil rises beyond $83.20 before of Chinese PMI and US Non-Farm Payroll Data today. Russian further output cuts eyed

WTI Oil Key Points

WTI pricing have risen over $83.20 per barrel for 4 consecutive days.

Russian officials decided to reduce oil output and will announce new limits the following week.

Rising WTI pricing are also supported by a significant reduction in American crude oil stocks.

Oil investors will keep an eye on the Chinese Caixin Manufacturing PMI and US NFP data

WTI buoyed by Fundamentals

The crude oil prices rose ahead of Friday’s trade period amid suggestions that Russia may prolong output curbs and data on inventories suggested a further drop in stocks.

As stated by Deputy Prime Minister Alexander Novak, Moscow will disclose fresh terms of an agreement it has with its OPEC+ allies within the next week.

On the other hand, the most recent numbers indicate that both India and China bought less crude in July.

The weekly oil status report released by the US (EIA) on Thursday. Showed a significant loss of -10.584 M bls for the entire week ending August 25th. Considerably less compared to the -3.267 million expected by -6.135 preceding.

So far on Friday, the US crude oil benchmark, the (WTI), has traded at $83,20. WTI. The values are up for the 4th day in a row on anticipation that Saudi Arabia & OPEC+ are going to keep restrict oil supply until the conclusion of 2023.

Other than the Chinese info, energy investors will focus on the US ISM Manufacturing PMI, (NFP), and Unemployed Rate. Which are coming during the US trading afternoon on Friday. These developments might have a considerable influence on the USD-determined WTI pricing. Crude investors will use statistics to identify potential trades based on the oil pricing.

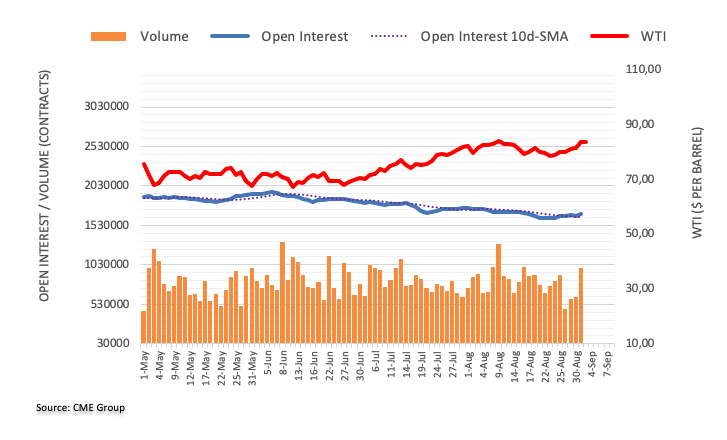

WTI Open Interest

On Thursday, open interest within the oil futures exchanges maintained its upward trajectory, increasing by near 29.1K contracts. Similarly, turnover grew for a third consecutive period, currently by roughly 367.3K transactions.

WTI is aiming for a rise to $85.00 mark in 2023. WTI prices maintained their multi-period climb on Thursday, Closing over the $83.00 mark a barrel, or 3-week highs. The increase was due to increased open interest plus volume. Which sets the path to feed the present trend to continue towards the Yearly top of $84.85 level.