Crude WTI Price Evaluation: Bulls stall as price retreats from 100-day simple moving average zone. Bulls stops at the moment.

Crude Oil Key Considerations

Prices for WTI Crude Oil are being rejected close to the 100-DMA and are declining from an earlier month-top

Bullish investors are influenced by last week’s continued gains and adoption over the 50-day SMA.

Now, any significant correction decline could potentially be viewed as a picking up chance and kept to a minimum.

Crude oil prices dipped on US dollar strength

On Monday, (WTI) Crude Oil prices encounter resistance close to the 100-day (SMA). As they attempt to cash in on the current advance seen during the last two weeks. In the start of the European period, the crude oil reaches a new daily bottom. But maintains some resistance under the rounded number of $73.00. The oil is presently trading in the $73.20-$73.25 range, off little more than 0.50% during the day. After making substantial gains on Friday that reached nearly a month’s top.

Crude oil lost some steam on weaker Chinese inflation numbers

Discouraging China data and mere talk of a US downturn may have made people less optimistic about the economic forecast.

Inflation indicators for both consumers and producers in China fell short of market forecasts. At the final day of June, overall CPI was 0.0% vs the 0.2% predicted and earlier. Contrary of being the -5.0% predicted and -4.6% before, the Chinese PPI showed -5.4% over the same period of time.

Janet Yellen, the secretary of the Treasury, described her trip to China as a move in the direction of a sure ground’ in the interactions among the two biggest economies in the globe. During this past weekend, it came to conclusion.

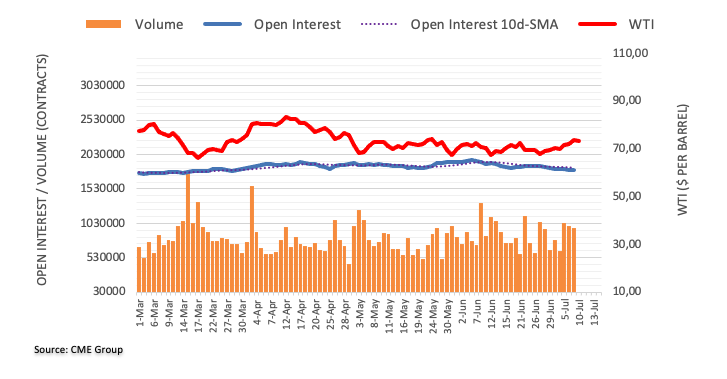

Trading futures Open Interest

According to early estimates from CME Group. The open interest in the oil futures exchanges declined during the 2nd round in consecutive days on Friday, Slipping down over 10K contracts. On the other hand, activity decreased during a second day in a row, today by about 28K contracts.

Crude oil Technical Analysis & Perspective

Even if the WTI contract increased by more than 4.5% this past week, swing conditions for trading persist.

During a period of time exceeding two months, the price stays between the range of 66.80 and 75.06. Moving away it has fluctuated from last Nov at 63.64 to 83.53. In light of this, historical ups and downs could act as support and resistance, accordingly.

Support on the negative side might be found at the threshold of 72.72, the previous lowest levels at 67.03, 66.82, 66.80, 64.36. and 63.64, As well as the previous low of 62.43 from the month of November 2021.

Barrier on the upside might be found near 75.06, 76.92, plus 79.18 before a group of break points with previous tops located in the 82.50–83.50 region.