WTI crude falls to about $70.50 over a bleak prospect. As predictions of a worldwide recession grow in near future

WTI Crude Oil Key Considerations

Following news that US Blinken had travelled to Saudi Arabia, WTI has fallen diagonally to close to $70.63.

To reinforce their position in the fight against chronic inflation. The central banks throughout the world are getting ready to boost interest rates once more.

As lending by commercial banks continues to decline owing to increasing interest rates, fears of an economic downturn will soar.

WTI Crude is also impacted by strong US dollar

The European afternoon saw a sharp sell-off in WTI oil futures via the NYMEX. The price of oil has had a steep plunge and is now close to $70.63. A great deal of gains in crude oil have been given up, adding to the confidence over Saudi Arabia’s output reduction.

After gathering momentum close to the crucial support level around 103.80, the US Dollar Index has shown an adequate rebound move. The oil price has also been impacted by an impressive rebound in the USD Index.

Saudi Arabia announced a reduction in output, but oil prices have yet to reverse their downward trend. It appears that the main factor bringing down the value of oil is gloomy demand. To reinforce their position in the fight against persistent inflation. The central banks throughout the world are getting ready to raise interest rates once again.

The major central banks are expected to raise interest rates again

The Bank of England (BoE), the (ECB), and the US Fed are all anticipated to tighten up their monetary policy this month. Although opinions on the Fed’s interest rate move vary. Everyone is certain that monetary authorities from the same continent will hike their interest rates without a doubt.

Hopes of a worldwide economic crisis will soar following another round of rate hikes. Since commercial banks’ lending activities will further decline. Traders should be mindful that Germany is currently predicting an economic downturn. Following two straight quarters of declining gross domestic product (GDP).

Technical Perspective

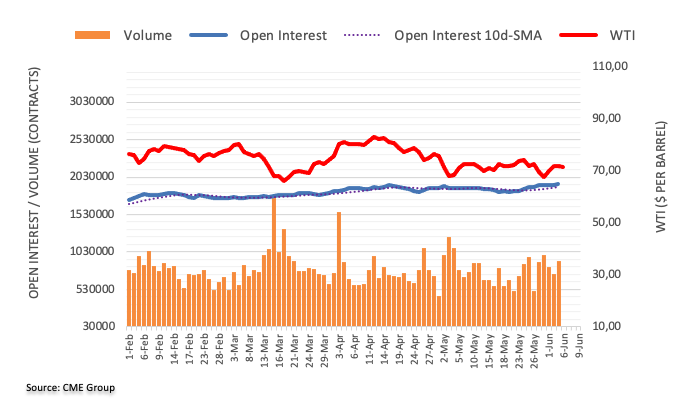

Starting the week, open interest in the oil futures exchanges increased for a 5th day in a row. At this point up over 11K contracts. Volume increased by over 167.8K contracts along the identical direction, reversing two successive daily recoveries

WTI first aims for the 200-day SMA before $80.00 On Monday. Increasing open interest and turnover helped WTI prices extend the rebound to the limits of the $75.00 per barrel degree. In contrast, more increases are still expected to occur in the very close future. With a 200-day SMA at $79.17/bbl being the initial objective before the crucial $80.00 / barrel.

Source CME group