WTI is hovering over 69.00; a decline is inevitable due to economic concerns. Futures for West Texas Intermediate (WTI) on the NYMEX are fluctuating over 69.00 zone.

WTI Crude Oil Key Points

In advance of the US API’s release of its oil inventory figures, the crude oil price has held steady over $69.00.

The likelihood of another rate increase by the Fed is increasing due to robust US consumer expenditure. And favorable labor market conditions.

As Russia continues to supply the world economy with cheaper energy, tensions between the two countries have stayed higher.

WTI oscillate over 69.00 level

In the early European session, (WTI) futures on the NYMEX are fluctuating over 69.00. As worries about a worldwide economic slump soar, the price of oil is anticipated to continue falling.

The Fed interest rates are above 5%, which indicates that the outlook for the US economy is remains poor. Fears of a recession are being fueled by increased anticipation that there would be another interest rate increase. At the meeting of monetary policy in June. Given the robust consumer expenditure and positive job market conditions. After a series of quarters of declining GDP estimates. The German economy is currently in a recession.

It is important to note since China is the world’s largest oil importer. And slow economic growth there could have a huge influence on oil prices.

OPEC+ Meeting this week is Important

The OPEC meeting scheduled for this week will be closely watched. As production cutbacks to bolster oil prices are expected to be addressed. As Saudi Arabia continues to provide the world economy with cheaper oil. Undercutting Russian efforts to raise energy costs, tensions between the two countries have stayed higher.

Further production cuts by OPEC+ countries excluding Russia could have very little impact. Because Russia is no longer firm in upholding the agreement.

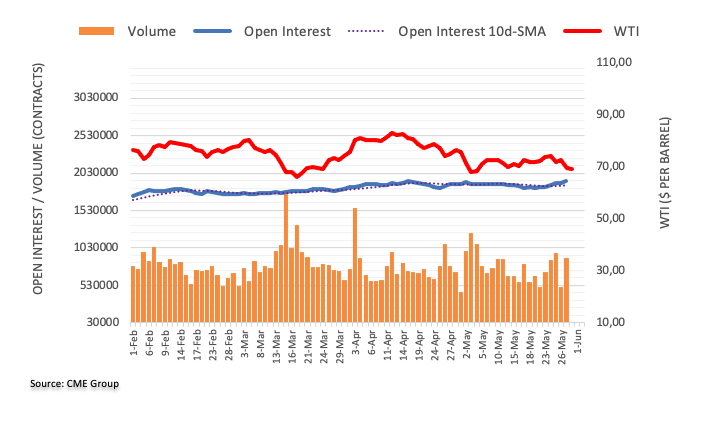

Taking into account CME Group’s updated readings for the crude oil futures marketplace. Investors increased the size of their open interest holdings on Tuesday by about 21.1K contracts. Reversing the previous day’s decline. Following suit, activity rose by about 381.1K contracts.