US Dollar Prediction: would Investors ditch more Fed cut odds? Jerome Powell was unable to stop July rate reduction speculation.

US Dollar Principal Analysis

The Fed rate decision caused the US dollar to carefully end the week down. Rates were increased by 25 basis points by the central bank, which also hinted at a break in the cycle of tightening. Chair Jerome Powell attempted to emphasize during his press conference that the committee’s prognosis does not now support rate reduction. Will the markets accept him? Without a doubt.

Markets had around a 50% chance of a rate decrease by July after the Fed. Then came Friday’s release of the non-farm payrolls. The economy created 253k new employment in April. Once more, this result was substantially more significant than the predicted 185k. Suddenly joblessness dropped to 3.4% while the average hourly wage increased by 4.4% year over year.

Given these positive figures, overnight index swaps have only modestly reduced July rate-cut forecasts. This possibility is now approximately 40.5% likely.

No short-term interest rate increase like by Fed until more data confirmation

The US Dollar may now be in a positive position moving forward as a result. Members John Williams, Christopher Waller, James Bullard, and others will provide us with some Fedspeak. The US Dollar might be in for a surprise if officials maintain their downplaying of prospects for short-term relief.

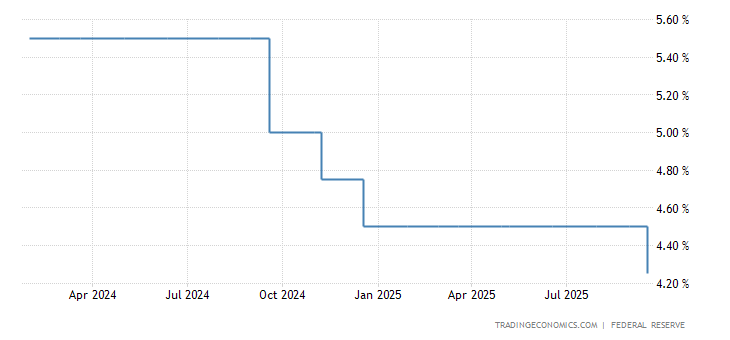

US Fed Rate Graph

Additionally, the next US inflation data will be closely watched by the markets. CPI is anticipated to remain constant on Wednesday at 5.0% y/y, the same as in March. The core print is assessed to be somewhat ebbing, from 5.6% to 5.5 percent. More evidence of price pressures that are more persistent might support the dollar’s gain. Particularly if risk aversion hits Wall Street and increases interest in safe-haven investments.

Technical Analysis and Prognosis

“The US Dollar (DXY) remains steady above a crucial support area. From 100.82 and 101.29 would be this. Lows from May 2022 constitute this region.

The importance of either a breakaway or a move-up has increased due to the persistent failure to break beyond this range. The 100-day (SMA), which might be a significant barrier in the coming week, should be closely monitored. If not, rising upwards reveals the top from March at the 105.88 mark”

Important Considerations to watch

The initial rise in the value of the dollar was probably influenced in part by traders covering their short bets in the currency.

While rivals like the ECB have become more aggressive, the dollar has slid from a 20-year top in Sept as markets prepare for the possibility that the Fed is close to the conclusion of its hiking cycle.

The chance that the Fed would lower interest rates in the subsequent half of the year is factored in by investors. Even if the economy is slowing down, there remain some areas of strength, therefore traders are cautious to become very pessimistic on the US dollar at this time.