WTI and Brent crude oil rise meet technical challenges. US stockpiles are falling. According to API statistics, production is increasing.

WTI Rally Confronts a slew of technical obstacles to rise

The prices of crude oil were on an upward trajectory this week, with the commodity gaining nearly 5% on supply worries. Yesterday, reserves in the United States dropped, with the Strategic Petroleum Reserves, hovering at levels that were last observed in Dec1983.

The absence of action from the US to refill the SPR has surprised many. Especially since prices this past week matched the goal range set by the US Department of Energy. According to API statistics, US inventories fell by 6,076 million barrels for the week ending March 24, in contrast to forecasts of a 187k barrel increase.

Meanwhile, US oil production increased by 12.3 million barrels per day for the week ending March 17. Leaving production levels 700K barrels a day above the same period a year ago. The results, combined with the US dollar’s continued to decline despite a positive CPI reading, held oil prices stable over Tuesday’s US period.

WTI and Brent’s crude hindered by Russian nuclear weapon rhetoric

Supply worries persist, with concerns of additional sanctions against Russia rearing their ugly heads. This follows remarks by Russian President Vladimir Putin about the placement of tactical nuclear weapons in Belarus. Any statement from G7 members regarding additional sanctions could serve as a further driver for the price of oil

In terms of economic event risk, the EIA will issue updated numbers of stocks for the week ending March 24 later in the day. A drop in stockpiles and a miss on forecasts might also maintain prices stable. Prior to the publication of US PCE reports on Friday.

TECHNICAL OUTLOOK FOR WTI

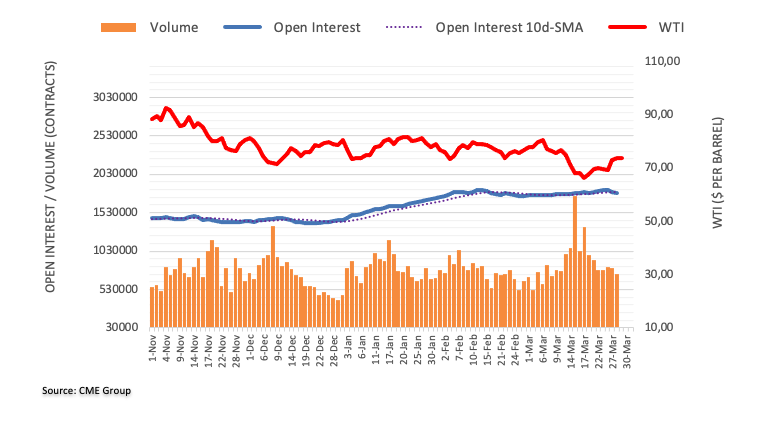

Based on a technical standpoint, WTI is making higher peaks and fewer lows as it nears $75 per barrel. As we approach the 50-day MA around the $75.89 handle. It has now registered a daily closure over resistance provided by the Feb and Jan swing lows

On the other hand, a decline from here could result in a repeat of the 2022 lows. Which offered some resistance this past week near the $ 70-a-barrel level. A more intraday support level can be found at $71.50. That was the March 23 swing peak and might keep prices maintained if prices fall.