European market futures are higher as banking optimism. Friday, with sentiment bolstered by actions taken both in Europe and the US to back lenders facing pressure.

European markets’ optimism grows on bailouts

First Republic Bank (NYSE: FRC) was affected by the backwash. It was brought on by the failure of two other U.S. lenders. They received a $30 billion deposit infusion.

This came after the Swiss National Bank announced late Wed that troubled European bank Credit Suisse (SIX: CSGN) had received a financial lifeline. Boosting its liquidity as it battles with significant customer outflows

In Germany, the DAX futures contract moved up 0.4 percent. In France, the CAC 40 futures contract moved up 0.1%, and in the UK, the FTSE 100 futures contract moved up 0.8%.

European markets remain resilient despite ECB 50bp rate hike

On Thursday, the European Central BIndicating that policymakers are still optimistic that Bank increased interest rates by 50 basis points the region’s banking industry’s resilience despite the current gloomy economic climate.

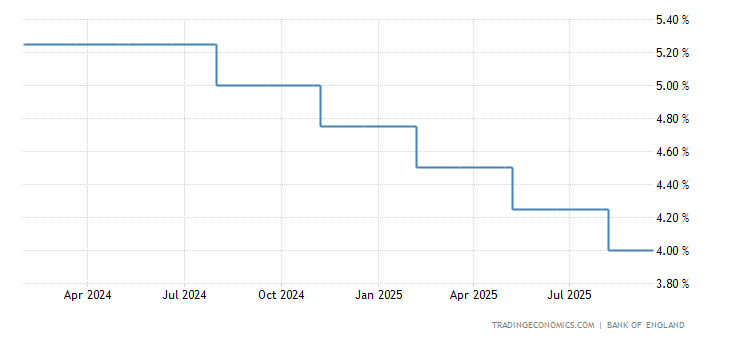

TRADINGECONOMICS.COM

Source: In a week with few economic data releases. The Eurozone’s final CPI figures are coming later in the session. These figures are predicted to show that inflation increased by 0.8% in the month. and, 8.5% in the year in Feb.

The corporate scenario

In terms of corporate news, the banking industry will continue to be in the spotlight. According to Bloomberg, UBS (SIX: UBSG) and Credit Suisse oppose a forced merger. Which could be a possible solution to the latter’s ongoing issues.

In other news, Sanofi (EPA: SASY) announced it would reduce U.S. list costs for Lantus. It’s the most prescription insulin product, starting in 2019. This follows competitive U.S. actions of the same nature.

Crude oil outlook for Friday

In anticipation of a reaction from OPEC and its allies to the week’s sharp selloff. on banking sector jitters due to worries harming global economic activity. Oil prices increased on Friday.

According to reports, Saudi Arabia’s and Russia’s energy ministers met on Thursday in Riyadh, to discuss measures to support the crude market. Which is expected to suffer its biggest weekly loss of the year.

On April 3, the advisory council of the Organization of the Petroleum Exporting Countries (OPEC) and their allies, including Russia, will convene.

U.S. oil futures were trading 0.4% higher at $68.65 per barrel by 3:00 ET. While the Brent contract increased 0.4 percent to $75.03.

This week, both standards experienced their steepest weekly declines since Dec. Falling to their lowest levels in more than a year.