The euro rally pauses ahead of the Europe inflation figures. On Thursday, the euro lost ground to a rising dollar after recording its biggest one-day gain in a month. This happened ahead of statistics on inflation in the eurozone, which could have reignited the currency’s rally.

Euro Following hotter-than-expected German inflation Feb.

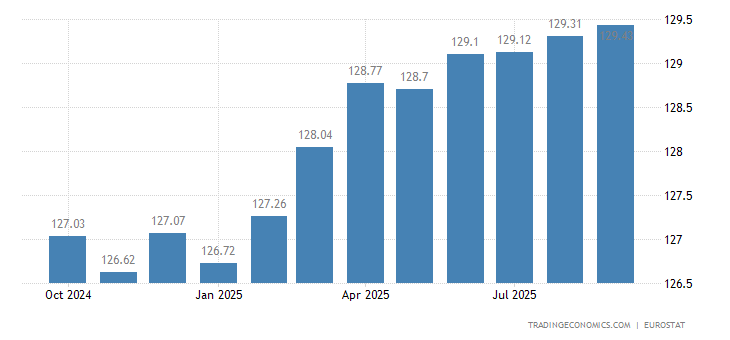

Increasing pressure on the European Central Bank to raise rates after surprisingly strong readings in France and Spain prior to the release of inflation statistics at 1000 GMT, it was 0.35 percent lower at $1.0633. However, analysts think that the euro is about to increase as markets prepare for yet another high figure.

Despite forecasts, today’s statistics for the eurozone may also indicate still another rise rather than just a slight decline. Similar rules apply to underlying inflation.

Euro could hit 1.07. If EU inflation data are unexpected

Today, when the inflation rate for Feb is released. The Euro may eventually overtake the dollar in popularity. Depending on how high the final Feb rate turns out to be, the shared currency might experience significant backing.

The Euro’s day or and market sentiment

The market anticipates stable core inflation at 5.3 percent and a small decline in the headline inflation rate to 8.3 percent The market may anticipate the ECB to increase rates even further or at least maintain them for a longer period of time. If the statistics come in considerably higher than expected, which might push the euro price well above the 1.07 mark.

Hardline ECB behavior highlights support for the euro

We feel confident looking for a 3.50 percentage-point ECB terminal rate given the assumption that price pressures will stay high despite a better macroeconomic context.

Although recently implied policy assumptions may have caused the market to overshoot. Analysts anticipate further ECB activism and/or a strengthening revival narrative to maintain a positive medium-term EUR picture.

Today, attention is on the Core European CPI for Feb. On Wednesday, the EURUSD climbed to a brand-new weekly peak near 1.0700. The two are expected to stay confined in a 1.0600-1.0700 range on Thursday.

Watch for Core Eurozone CPI to reach a fresh cycle high.

The Core Eurozone CPI report for Feb is expected to come in higher than the average estimate of 5.3 percentage points year-over-year.

The European Central Bank has not made many objections to the cycle’s rebalancing, which already appears to price the reserve rate above 4.00 percent at the beginning of the following. year.

That seems extreme, then let’s wait to hear what the ECB minutes released today have to offer.

Technical Perspective

The EUR/USD rise lost steam when it encountered the 20-day Simple Moving Average (SMA) just below 1.0700. The euro has been trading positively for the week. Though, the upswing is beginning to tire. To breach the crucial barrier near 1.0700, which would pave the way for additional gains, the duo would need to exert more force.

Although the RSI is moving south, indicating some consolidation before another potential leg high. The EURUSD’s 4-hour graphs show modest upside risks.

The recent rise may experience a correction that goes up to 1.0635. The 20-Simple Moving Average, which is placed around 1.0600, is the next support level, which is located at 1.0610. The short-term outlook would turn bearish with a slide downward.

Levels of support: 1.0585 1.0630 1.0680

Levels of resistance: 1.0700 1.0745

The European stocks decline

The DAX indicator in Germany, the CAC 40 in France, and the FTSE 100 in the United Kingdom all traded 0.4 percent weaker at 04:10 ET (09:10 GMT).

Speculators in both the U.S. and Europe are worried that the rising cost of borrowing will have a negative impact on future growth because inflation has been challenging to control.