Stocks are expected to open higher on retail earnings. After three major U.S. benchmark indices closed lower on Friday, March S&P 500 futures (ESH23) are rising steadily +0.46percent this morning. Firmer US economic figures bolstered anticipations of more assertive Federal Reserve raising rates.

Losses in the Technology, Consumer Services, and Healthcare sectors weighed heavily on the 3 key US stock indexes.

The S&P 500 fell to a 5-week drop. The Dow fell to a two-month low, and the Nasdaq fell to a 4-week low in Friday’s trading session, the biggest weekly decline of 2023.

Stocks impacted by several economic data

The core PCE Price Index, the Fed’s favored measure of inflation, stood at +0.6% m/m and +4.7% y/y in Jan, according to data released on Friday.

Higher than anticipated at +0.4 percentage points m/m and +4.3 percent y/y. Raising concerns that the Fed may need to keep rates higher for longer to keep inflation under control.

In addition, personal spending in the United States increased by 1.8% m/m in Jan, beating expectations of 1.3 percent m/m.

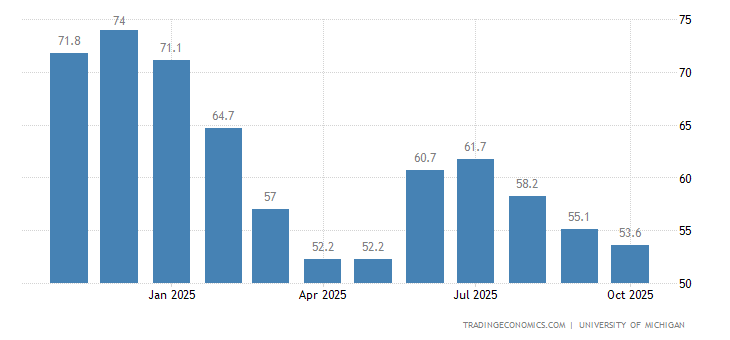

Furthermore, the consumer sentiment index at the University of Michigan reached a 13-month peak of 67.0 in Feb.

Stocks and Fed speaker’s statements

Cleveland Fed President Loretta Mester stated on Friday that “inflation continues to remain excessively high” and suggested that the Federal Reserve will have to raise interest rates above 5 percent in order to control inflation.

In addition, Boston Fed President Susan Collins stated that more interest rate hikes are needed to combat excessive inflation. She expects more rate hikes to reach a sufficiently restrictive level and then hold there for some, possibly for a longer time.

Furthermore, Fed Governor Philip Jefferson stated that “the continuing disparity among both demand and supply of labor. Combined with the large share of labor costs in the services sector, suggests that rising inflation may come down only gradually.”

Investors have priced in a 25 basis points rate increase

In the meantime, interest rate futures in the United States have factored in a 73.8percentage possibility of a 25 basis point rate increase. And a 26.2% chance of a 50 basis point hike at the March meeting of the Federal Reserve.

Speculators will be watching a slew of economic statistics this week, along with the U.S. CB Consumer Confidence, Goods Trade Balance (preliminary), S&P/CS HPI Composite – 20 n.s.a.

Source: UoM

Upcoming Important data in focus

Chicago PMI, Richmond Manufacturing Index, Manufacturing PMI, ISM Manufacturing PMI. ISM Manufacturing Employment, Crude Oil Inventories, Initial Jobless Claims, Nonfarm Productivity (preliminary).

Unit Labor Costs (preliminary), S&P Global Composite PMI, Services PMI, ISM Non-Manufacturing PMI. And, ISM Non-Manufacturing Employment is the leading indicator.

Today, all eyes are focused on the U.S. Core Durable Goods Orders data. Which will be issued within the next few hours.

Economists predict that January Core Durable Goods Orders will be +0.1% m/m, higher than the prior value of -0.2% m/m.

Speculators will also be looking at the Pending Home Sales figures in the United States. Which was up 2.5percentage month on month in Dec. Economists predict that the new figure will be +1.0% m/m.

Statistics on US Durable Goods Orders will also be published today as well. Forecasts show that this figure will be -4.0 percent m/m in January, down from +5.6 percent m/m in Dec.

European and Asian stocks today

The Euro Stoxx 50 futures are up 1.45 percent this morning, led by gains in energy and retail stocks. As market participants are waiting for more regional inflation statistics throughout the week.

This week, speculators will be looking for further hints on the near-term direction of interest rates as preliminary Feb data on Germany, France, Spain, Italy, and the Eurozone is released.

The European Central Bank is widely expected to raise interest rates by 50 basis points at its upcoming meeting in mid-March. With traders pricing in another 75 basis point move in the eurozone well before summer ends.

In mainstream news, Associated British Foods Plc (ABF.LN) shares were up more than 1 percent after the Primark owner elevated its financial guidance for the fiscal year 2022-23.

Today saw the release of Italy’s Consumer Confidence, the Eurozone’s M3 Money Supply, and the Eurozone’s Consumer Confidence data.

The Shanghai Composite Index fell today as speculators worried about upcoming Chinese economic statistics.

Investors are looking forward to the release of China’s PMI data on Wednesday, which is anticipated to indicate a mixed turnaround in the country’s economic activity.

Around the same time, Japan’s Nikkei 225 Stock Index ended lower. Bogged down by losses in the Textile, Chemical, Petroleum & Plastic, and Banking sectors.

Around the same time, Japan’s Nikkei 225 Stock Index ended lower. Bogged down by setbacks in the Textile, Chemical, Petroleum & Plastic, and Banking sectors. The Nikkei Volatility Index, which considers the implied volatility of Nikkei 225 options, fell 5.20 percent to the 16.59 mark.

The EUR is underpinned by USD

The EURUSD is starting the new week near two-month lows, having fallen fairly consistently throughout February.

The fact that this is primarily a ‘Greenback’s strength’ narrative instead of a ‘Euro weak spot’ may provide some solace to Euro bulls, but they still have a job to be doing.