Asian stocks fell after a report on inflation shocked Wall Street, As, a result, benchmarks on Wall Street had their worst decline in four weeks on Friday. Shares fell in Asia as markets expressed dissatisfaction over inflation readings that came in higher than anticipated.

Asian stocks led to declines

The Hang Seng in Hong Kong dropped 0.7 percent to 20,836.08. While the Nikkei 225 in Tokyo declined 0.7 percent to 27,513.13. The South Korean Kospi fell 1% to 2,450.20.

S&P/ASX 200 in Australia fell 0.9 percent to 7,346.80, while the Shanghai Composite index lost 0.2% to 3,243.24. The benchmark in Taiwan fell 0.5%.

Broader Asian markets also declined as January’s U.S. producer price index data came in higher than anticipated.

Mirroring the month’s scorching consumer price index reading. The findings increased worries that the Fed will stick to its hawkish talking points and raise interest rates.

Asian stocks followed Wall Street

As the S&P 500 on the Wall Street lost 1.4 percent on Thursday as a result of the revelation that wholesale inflation slowed less than expected. Oil prices and U.S. futures also plummeted.

It concurred with a consumer price study from earlier this week that revealed; inflation isn’t slowing down as swiftly and cleanly as anticipated.

The government revealed that the economy expanded at a modest 2.6 percent in terms of annualized rate in 2022. Then slowed more than anticipated in the final quarter of the year, to a 1.3% annual expansion.

The government revealed that the economy expanded at a modest 2.6 percent in terms of annualized rate in 2022. Then slowed more than anticipated in the final quarter of the year, to a 1.3% annual expansion.

The GDP decreased by 1.5% on a quarterly basis from October to December.

The Nasdaq composite dropped 1.8 percent to 11,855.83 on Thursday, while the Dow Jones Industrial Average shed 1.3 percentage points to 33,696.85.

S&P 500 closed at 4,090.41 points. Some of the largest weights on the benchmark index were a 2.7 percent decline for Microsoft, a 3.3% decline for Nvidia, and a 4.7% decline for Tesla.

Markets have been volatile lately due to concerns that consistently strong inflation may force the Federal Reserve to increase interest rates even more.

Higher rates can reduce inflation but it also holds back the value of investments and increase the likelihood of a severe recession.

The Fed’s task is still not done, as evidenced by the inflation data’s continued strength, and the likelihood of an extended cycle is growing.

Treasury yields increased on Thursday.

As traders increased their wagers on how high the Federal Reserve will hike interest rates to battle inflation, Treasury yields increased on Thursday.

Rising rates are detrimental to the financial markets and the economy. Other economic statistics diminished hopes that the Fed could control inflation sans precipitating a major recession.

Before the release of the inflation report and from earlier this month’s low of less than 4.10%. The yield on the 2 Treasury, which often reflects expectations for Fed action, increased to 4.67%.

Since November, when the yield rose to levels last seen in 2007, it has nearly hit its highest level.

Before the release of the inflation report and from earlier this month’s low of less than 4.10%. The yield on the two-year Treasury, which often reflects expectations for Fed action, increased to 4.67%.

According to the inflation report issued on Thursday, wholesale prices rose by 6% last month compared to the same period in the previous year

According to the inflation report issued on Thursday, wholesale prices rose by 6 percentage points the previous month. Compared to the same period in the previous year.

Even after removing prices for food, energy, and other layers, inflation increased in January on a monthly basis, which is even more problematic.

Crude oil fell and the US. Dollar rises vs, Yen. PPI Impact

In additional trading on Friday. The New York Mercantile Exchange electronic trading saw U.S. benchmark crude oil drop 84 cents to $77.65 per barrel. The benchmark price for international trade, Brent crude, dropped 83 cents to $84.31 per barrel.

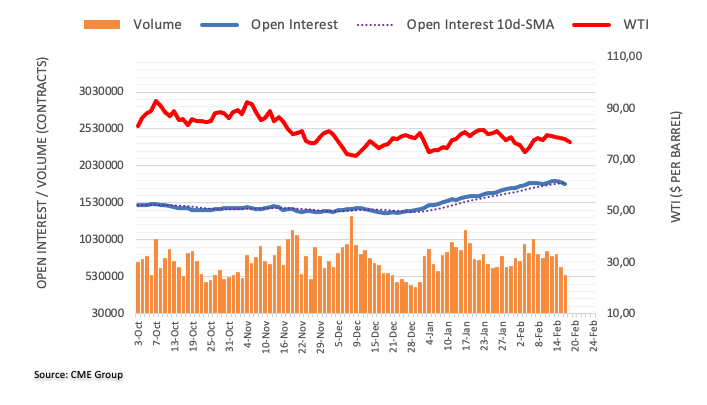

When taking into account advanced prints from CME Group for the markets for crude oil futures. The open interest decreased on Thursday for the second straight session. And, now by around 19K contracts. Following suit, volume decreased by over 119K contracts