US crude oil is ready for a weekly rise on China’s demand prospects. As optimistic expectations for Chinese demand linger with global recession fears

Crude oil starts the session on a dip

Despite falling below $78 per barrel on Friday. West Texas Intermediate futures still are up almost 6percent on the week.

Although the market is still awaiting a prolonged recovery from China. Some analysts believe that during this year, as a result of the country’s turnaround,

Brent crude will return to values over $100 per barrel. Investors of options anticipate this recovery to occur even earlier.

Crude oil weighs Recession and Demand Scenario

Much of the world economy remain at risk of recession. The Federal Reserve officials in the week indicated that additional tightening of monetary policy was required to fight inflation.

Oil price predictions from Goldman Sachs Group Inc. have been lowered due to a “moderate easing” of its 2023 balance.

Demand on the market is recovering, and mobility in China, the US, and Europe is all improving.

Crude oil recovery likely

After a three-day spike at the beginning of the week. Crude oil is on course to post its largest weekly gain since mid-January.

Rises were supported by an increase in Saudi Arabia’s crude pricing for Asia. A sign of trust in the demand prospects, as well as a string of supply disruptions from Norway to Turkey.

Due to supply problems, Brent has firmed up in a bullish backwardation structure. In backwardation, the prompt spread—The difference between its two closest contracts—was 44 cents a barrel, up from 23 cents a week earlier.

Crude WTI: $82.60 is the next price increase.

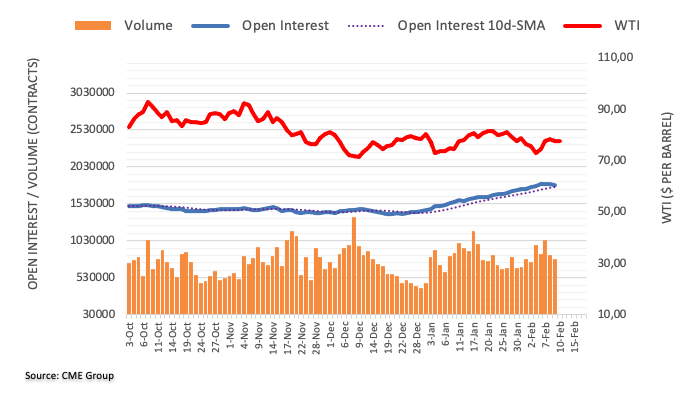

On Thursday, the WTI price reversed a three-session bullish run. The downturn, meanwhile, coincided with falling open interest and volume. Opening the way to the continuation of the upward trend in the very near future. With the first obstacle being the top price of $82.60 from 2023. (Jan 23).

Production of Permian oil might increase by 500K Bpd this year.

According to Plains All American Pipeline, L.P. (NASDAQ: PAA), a pipeline firm based in Houston, Texas. The production of Permian crude will increase by 500,000 barrels daily this year.

When up to mark long-haul system utilization for its Cactus pipelines in Texas, the firm made this disclosure during its most recent earnings call.

PAA reported Fourth – quarter sales of $12.95 billion in 2022 compared to $12.98 billion in 2021. However, net income for the quarter fell by 42percent to $263 million and net cash fell by 47percent to $335 million.

Oil Current Picture

So far, the schedule has been calm, with market mood being controlled by Federal Reserve policymakers. We will receive further news on US unemployment claims later this afternoon. Which might support the US greenback once more and cause WTI to decline.

TECHNICAL PERSPECTIVE

Since printing a double bottom pattern and establishing support near the Jan swing low. The WTI has staged a sizable technical recovery. The 50-day MA may now act as dynamical support as the 100-day MA moving average is brought into focus as it has broken back just above. It’s possible that we will retrace our steps until elevated levels given how quickly we broke through support.

The recent turbulent price action across markets and the continual shift in attitude have hindered most instruments from following with any confidence. Despite the fact that the fundamentals are aligning for a drive higher.

With 69% of investors presently holding long positions, retail traders are presently Long on Crude Oil. In the fact that traders are long crude oil prices means that prices may decline