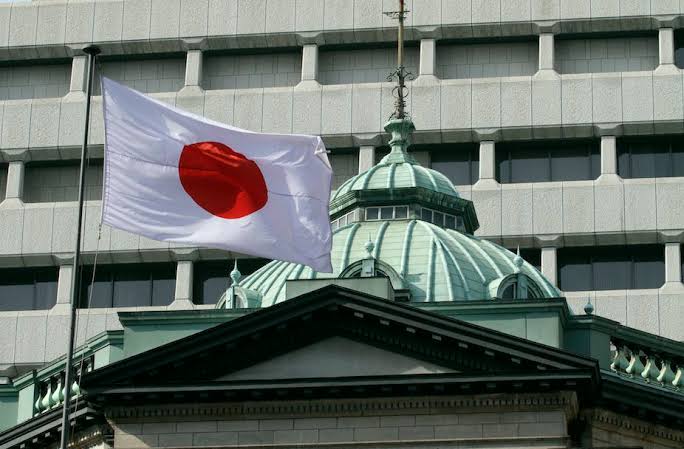

The Bank of Japan (BoJ) announced an unforeseen bond purchase operation for the second time in one day, according to Reuters on Thursday.

It was already announced that the Japanese central bank will buy emergency bonds.

In addition to a daily offer to buy 10-year paper at 0.5%, the BoJ also offered to buy JPY 600 billion worth of one-to-ten-year bonds and limitless quantities of two- and five-year notes at a set yield.

The BoJ’s actions continue to have little impact on the USD/JPY, which fell 0.60% on the day to 133.68.

With the market being thin at the end of the year, risk-off flows are dominant and increase demand for safe haven assets like the Japanese Yen.