VOT Research Desk

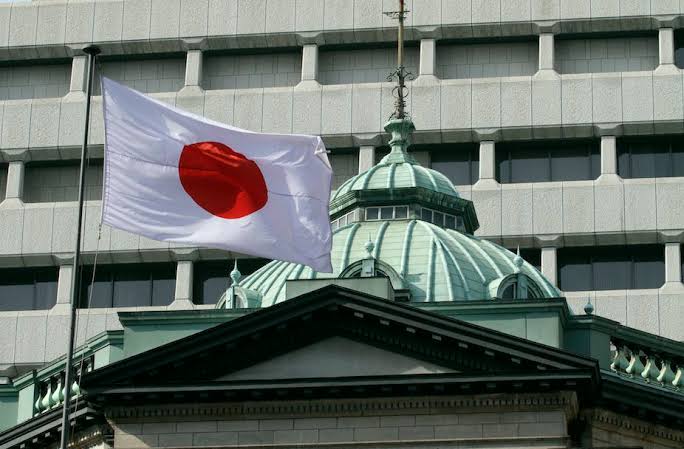

According to the most recent data from the Japanese Bankers Association, Bloomberg reported on Tuesday that should the Bank of Japan (BoJ) relax its control over 10-year JGB yields, the nation’s banks might incur losses on their government bonds totaling $1.1 trillion.

According to Bloomberg, Japan’s financial regulator is assessing how susceptible lenders would be to a sudden decline in government bond prices should the country’s central bank decide to change its ultra-loose monetary policy in the future.

Earlier this month, BoJ Deputy Governor Masayoshi Amamiya stated that if yields increased by 1%, the central bank would have an unrealized loss on its holdings of Japanese government bonds of JPY28.6 trillion ($211 billion).