VOT Research Desk

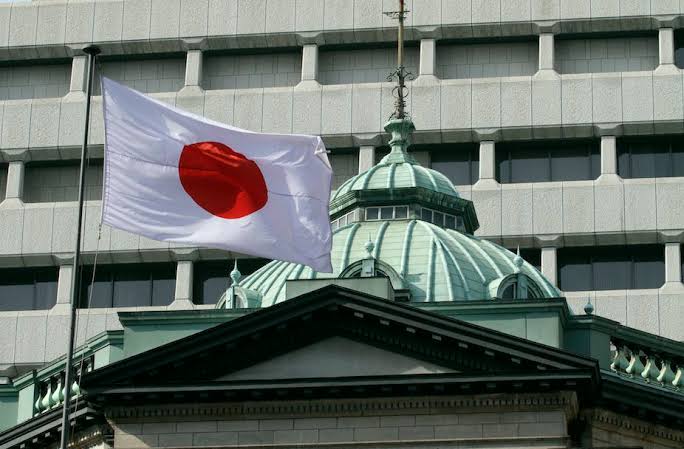

According to Masayoshi Amamiya, Deputy Governor of the Bank of Japan (BoJ), Japan’s inflation is currently extremely high, but it is expected to go back to 2% next year.

Even if the Bank of Japan suffers a short-term loss on its asset holdings, this will not impair its ability to guide monetary policy effectively.

If yields rise by 1% throughout Japan’s whole yield curve, the BoJ’s bond holdings will suffer an assessment loss of 28.6 trillion yen.

The level of uncertainty about Japan’s economic forecast is extremely high. At the time of writing, the USD/JPY is trading at approximately 135.25, undeterred by the BoJ’s remarks.